Are stablecoins safe? What’s the safest stablecoin for businesses in 2023?

We continue our series with a look at how market growth and regulations are establishing stablecoins as mainstream financial instruments.

.avif)

Introduction

Cryptocurrencies have emerged as a viable alternative to traditional methods of payment and settlement.

Today, stablecoins account for around 10% of the entire cryptocurrency market, measured by market cap. While the 2022 cryptocurrency crash saw the stablecoin market contract, today overall market capitalisation and trading volumes are almost back at their 2022 peak, while 75% of digital asset owners reportedly now hold stablecoins. Around the world, governments are now legislating for stablecoins to be a regulated payment method, which in turn should accelerate adoption and innovation.

Despite their scale, some businesses perceive stablecoins as risky, because they sit outside the traditional banking and finance ecosystem. To mitigate this risk, most businesses wanting to process stablecoin payments work with a partner, that takes on the full exposure to the stablecoin. Fintechs businesses (such as BVNK) collect the stablecoin payment and manage the trade to a fiat currency, leaving their clients with all the upside of stablecoin adoption and none of the risk.

In this article, we will evaluate the safety of stablecoins, both as a medium of payment and settlement, and a store of value.

Are stablecoins safe?

To evaluate the safety of stablecoins, businesses should look at a variety of criteria. In this article, we will compare the safety of stablecoins versus other cryptocurrencies, such as bitcoin, we’ll look at how different types of stablecoins can mitigate risks, and we’ll give you our pick on the stablecoins that should be on your radar. We will also take a broad look at how regulations around the world are impacting the safety of stablecoins.

Stablecoins vs cryptocurrency – which one is safer?

Let’s start by defining what we mean by a stablecoin, and how it differs to other cryptocurrencies.

A stablecoin is a type of cryptocurrency that is designed to minimise price volatility. It does this by pegging its price to a more stable asset, typically a fiat currency or a ‘hard’ commodity such as gold. To keep the price of their coins stable, operators will maintain physical stocks of the underlying asset, or employ algorithms that adjust to fluctuations in demand and supply. These operators are typically private organisations or foundations (eg Tether is issued by Tether Limited; USD Coin is issued by Centre, a consortium founded by Circle).

Criteria 1: Price stability

Stablecoins mitigate one of the key risks of cryptocurrencies, namely their volatile prices. Cryptocurrencies that suffer from dramatic price fluctuations create risks for businesses that use them for payments and settlements. The unpredictability makes it difficult to price products and services accurately, or determine the optimum time to convert cryptocurrency into fiat. In turn, this can affect cash flow, profitability and financial planning. Businesses that are trading cryptocurrencies as a balance sheet asset are also hampered by this uncertainty.

However, the stability of a stablecoin’s price is highly dependent on how it has been designed to maintain its peg. There are four different ways that stablecoins try to do this.

Fiat-collateralised stablecoins

Fiat-collateralised stablecoins (also known as off-chain stablecoins) are backed by reserves of traditional fiat currencies, such as the US dollar, held in a bank account or custody service. The issuer matches the stablecoin supply with an equivalent amount of fiat currency. Examples of fiat-collateralised stablecoins include Tether (USDT) and USD Coin (USDC).

Commodity-collateralised stablecoins

Commodity-collateralised stablecoins are backed by reserves of tangible assets, such as gold, silver, or other commodities. The issuer holds a certain quantity of the commodity in reserve for each stablecoin in circulation, in order to tie the value of the stablecoin to that of the underlying commodity. Examples of commodity-collateralised stablecoins include PAX Gold (PAXG) and Tether Gold (xAUT).

Cryptocurrency-collateralised stablecoins

Cryptocurrency-collateralised stablecoins (also known as on-chain stablecoins) are backed by a reserve of other cryptocurrencies, such as Ether (ETH) or bitcoin (BTC). These stablecoins use smart contracts to lock in cryptocurrency stock. Examples of cryptocurrency-collateralised stablecoins include Dai (DAI) and Wrapped Bitcoin (WBTC).

Algorithmic stablecoins

Algorithmic stablecoins (also known as non-collateralised or seigniorage-style stablecoins), use algorithms and smart contracts to control the supply and value of the stablecoin. When the price of the stablecoin is above its peg, the algorithm increases the supply to bring it down, and vice versa. USDD is an example of an algorithmic stablecoin.

Of these different types of stablecoins, algorithmic stablecoins have proved to be less reliable, and are more prone to sell-offs when the market loses confidence. The TerraUSD stablecoin is a high profile example. In May 2022, it became depegged from the dollar and lost almost all of its value. Basis Cash, Empty Set Dollar and Dynamic Set Dollar are other examples of when an algorithmic stablecoin loses its stabilising peg.

Fiat-collateralised stablecoins are not immune to risks. Over the past few years, some of these stablecoins have broken their peg. In March 2023, USD Coin (USDC) lost its dollar peg, dropping to as low as 87 cents, as a result of $3.3 billion of reserves held at the failed Silicon Valley Bank (SVB). When the bank collapsed, USDC holders quickly redeemed over $1 billion of USDC for dollars, causing the dramatic price slippage. Tether (USDT), the largest stablecoin by circulation, temporarily lost parity to the dollar for a few days in May 2022, falling as low as $0.9959. A month later it had slipped again to $0.9975. While these drops don’t seem large, they can have profound impacts for businesses that are using them to settle payments or that hold a large volume of them on their balance sheet. But stablecoins have regularly demonstrated their resilience. In all three examples, the peg was restored within a few days.

Criteria 2: Counterparty risk

The safety of a stablecoin is also dependent on how it is issued. The four types of stablecoin we met earlier in this article can be grouped by ‘centralised’ and ‘decentralised’.

Centralised stablecoins are issued and controlled by a single entity or organisation. The issuer holds the reserves backing the stablecoin and manages the supply of new coins. Both fiat-collateralised and collateral-collateralised stablecoins fall into this category. Users of these stablecoins must trust the issuer to properly manage the underlying reserves, as they also must do with banks and other traditional financial institutions.

Businesses should look for stablecoin issuers that publish independent audits of attestations of their reserves. For example, here is the transparency page for Tether, and this is the one for USD Coin. Even then, counterparty risk is not eliminated (as is also the case when working with any financial institution). For example, Tether, the largest stablecoin, holds its cash reserves at Deltec Bank, which is located in the Bahamas, and is not backed by the Federal Reserve and nor is protected by deposit insurance. Tether has also faced regular criticism for lacking transparency about where and how it holds its dollar reserves.

Decentralised stablecoins (eg cryptocurrency-collateralised and algorithmic) operate without a single controlling entity. The rules that determine how these coins are supplied and exchanged are set out in algorithmic mechanisms, and facilitated with smart contracts. Decentralised stablecoins are considered ‘trustless’, in that their code can be accessed and audited by anyone, and reserves and issuances are publicly recorded on the blockchains. However, decentralised stablecoins are never entirely independent. They can be influenced by their governance model and operating protocols. Business considering a decentralised stablecoin should review its whitepaper, governance model and security assessment. Here is the whitepaper for Dao, and for the Reserve Dollar (RSV).

Counterpary risk is not exclusive to stablecoins. All cryptocurrencies have centralised or decentralised models, or a balance of the two. Business should be equally vigilant about the owners and operational protocols of non-stablecoin cryptocurrencies; and the concentration of coin holders, validating nodes and miners, which can compromise decentralisation.

Criteria 3: Regulations

The regulatory landscape surrounding stablecoins is still evolving. The direction of travel is positive. Around the world, new regulations are being developed to protect merchants and their customers. A new draft bill in the United States proposes that the Federal Reserve approves any non-bank stablecoin issuers, including those located abroad but offering their stablecoins on US exchanges.

Among the factors for approval are the ability to maintain and prove reserves backing stablecoins; demonstrable technical expertise and established governance; and initiatives that promote financial inclusion and innovation. In the EU, the new MiCA framework (Markets in Crypto-Assets) is now in force, which subjects stablecoins to new obligations around transparency and consumer protection. In the UK, the new Financial Services and Markets Bill (FSMB) places similar regulatory oversight on stablecoins.

That said, compared with legacy fiat currencies, stablecoins and cryptocurrencies are unregulated. This creates two potential risks for businesses. First, and most obviously, they are unprotected if a stablecoin loses its peg, or worse still ceases operating. The voluntary closure of Fei, a cryptocurrency-backed algorithmic stablecoin, in August 2022 is a recent example. At the time it was the 17th largest stablecoin by market cap. The project citing amongst other factors “future regulatory risks” as a reason for shutting down.

More than one third of stablecoins have failed, which should serve as a warning to only trust tried and tested stablecoins with a strong management team behind them. It is also worth noting that traditional financial institutions also fail; in the US alone there have been 564 bank collapses since 2001. In any market, failures can be an important part in elevating the overall quality and safety levels.

As with the previous section on counterparty risk, evolving regulation is a challenge for stablecoins and other cryptocurrencies. However, as we just read, regulators do seem to be taking a more focussed approach to stablecoins, especially fiat-collateralised and commodity-collaterlised stablecoins. These stablecoins have more interoperability with traditional finance and monetary systems, and so provide enhanced benefits and risks. They also have a central operator, making it easier to determine regulatory accountability.

Some leading stablecoins, such as the Gemini Dollar (GUSD), Binance USD (BUSD) and Pax Dollar (USDP) are already regulated by the New York State Department of Financial Services, though its jurisdiction primarily covers financial institutions operating within the state of New York. The administrator of USD Coin (USDC), Circle, is regulated by the FCA in the UK, and by the Financial Crimes Enforcement Network (FinCEN) in the US. Advocates of stablecoins should be encouraged by this trajectory, as it paves the way to establish stablecoins as a legitimate form of payment.

Top use cases of stablecoins for payment leaders

Conclusion: So, what’s the safest stablecoin for business use in 2023?

The size of the stablecoin market is a marker of its safety. Stablecoin trades worth billions of dollars are made every day using stablecoins, with settlements reaching approximately $8 trillion in 2022, surpassing volumes of major card networks like Mastercard and American Express. By the end of 2023, it’s expected that on-chain stablecoin volumes will surpass Visa volumes, the world’s largest card network.

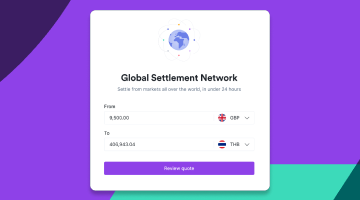

Businesses should also take confidence from the move of major financial incumbents to develop stablecoin solutions. Visa is exploring using the stablecoin USD Coin and the Ethereum network for global settlements. Stripe, one of the world’s largest fintechs, now offers merchants the ability to make payouts in stablecoin USD Coin. MoneyGram, one of the world’s largest remittance companies, uses USD Coin to make it easier for customers to transfer money internationally. BVNK’s own cross-border payment solution — Global Settlement Network — uses stablecoins to help businesses settle funds anywhere in the world and seamlessly trade between currencies.

But as we have explored in this article, different stablecoins present different risks. Algorithmic stablecoins do not have a great record of lasting success, but do provide transparency into their operations. Centralised stablecoins tend to be more stable and ‘in-touch’ with regulations, but we have seen more than one example of them losing their peg, or controversies about their reserves.

To help businesses decide the most appropriate stablecoins for them, we recently published an in-depth look at the 11 best stablecoin picks. We have selected these stablecoins based on their size. Together, they represent 98% of all stablecoins, measured by market cap. This is an important criteria. As we have read, stablecoins are not without risk. Those with relative maturity, deep liquidity and scale are more likely to withstand market shocks and navigate evolving regulations.

Of these 11 stablecoins, those with a fiat-collateralised mechanism (Tether, USD Coin, Binance USD, True, Pax Dollar and Gemini Dollar) present businesses with the easiest way to bridge traditional and cryptocurrency payment and settlement rails, and so support a flexible approach to stablecoin adoption.

Businesses can mitigate many risks and uncertainties of stablecoins by processing payments and settlements through a third party. The third party, often a fintech, can take on the full exposure to the stablecoin when converting it between fiat currencies. BVNK is one such fintech. Using our platform, businesses can incorporate stablecoins into their fiat payment and settlement flows.

Accelerate cross-border payments

Latest news

View allGet payment insights straight to your inbox

.avif)

.avif)

.avif)