B2B cross-border payments: complete 2023 guide

A guide to b2b cross-border payments – use cases, trends and key challenges.

.avif)

Why are B2B payments going cross-border?

Analysts estimate that $39.3 trillion of cross-border business-to-business (B2B) payments will be made in 2023, and reach $56.1 trillion by 2030. Add the wholesale banking sector to that (which includes institutional investments and currency trading), and the current value of cross-border B2B payments is $186.2 trillion, accounting for 98% of all international transactions.

Growth has been a consequence of globalisation that has increased trade, and so the need to transfer currencies across borders. That commerce has been driven by large enterprises trading in physical goods, but the growth in B2B ecommerce will see it become the leading contributor by 2030, worth $22 trillion.

This is B2B catching up with the consumer market. Increasingly, businesses are going to online marketplaces to purchase goods and services (eg Alibaba, Amazon Business, Upwork, ECPlaza). Meanwhile, the pandemic accelerated the move for many to open up or improve their online sales channels, and service demand from consumer businesses that needed to do the same.

They are being supported by the emergence of a new breed of fintech players that are making it easier and cheaper for large and SMB companies to send and receive B2B payments from abroad.

In this guide, we'll look at the opportunities and challenges of B2B cross-border payments, and how payments and finance teams in global businesses can benefit from innovations such as banking APIs, blockchains and stablecoins.

Common use cases for B2B cross-border payments

There are all sorts of reasons businesses need to move money internationally. Common examples include:

B2B ecommerce

B2B ecommerce sites need to take payments from customers in multiple countries, and also pay commission to sellers trading via a marketplaces.

Paying international suppliers

Businesses that import or export goods and services need to make cross-border payments to suppliers for the products they buy, or receive payment for the products they sell. This includes fees for agencies and freelance staff.

Software subscriptions

The rise of SaaS and cloud computing means companies now make regular monthly or quarterly payments to technology vendors around the world.

Paying salaries of international staff

Businesses need to make payments to workers in different countries, including wages, bonuses, redundancy settlements and dividends.

Institutional investments and trading

Companies that trade on financial markets (eg FX, stock exchanges, crypto platforms) will need to move and convert large volumes of currencies to execute positions.

Repatriating funds

International businesses often have separate legal entities and bank accounts in most, if not all of the markets they sell into, or they'll partner with a local payment provider that can administer this for them. At some point, they will likely want to repatriate these foreign funds to their domestic bank or between different legal entities in their business structure.

Treasury flows

To meet operational and regulatory liquidity requirements, a company's treasury department will need to move money around its organisation.

Accelerate cross-border payments

Major challenges of B2B cross-border payments

While many traditional methods for making cross-border B2B payments are proven and trusted, businesses can be underserved by them. The major international credit cards (eg Visa, Mastercard, AMEX) can charge merchants between 2-4% and a foreign exchange fee.

Wire transfers (also known as a bank-to-bank payment or bank transfer) such as Swift (the Society for Worldwide Interbank Financial Telecommunications) and SEPA (Single Euro Payments Area) rely on dislocated international banking networks. Payments in unfamiliar currency pairs may take complex paths through intermediary banks, adding time and cost to the transaction. In some cases, a cross-border payment can take several days and can cost up to 10 times more than a domestic payment.

In one survey, B2B companies in the US and UK reported that cross-border payments take 55% longer than domestic payments. Although this is a measure of total day sales outstanding (DSO), it is logical to presume that complexity around payments — from customer onboarding and KYC checks to settlement flows — was a contributing factor.

Availability is another issue with legacy payment systems. Most banks around the world still operate on a 9-5 basis, which means that money being sent abroad may have to wait until the following day (or days for weekends and public holidays) before the payment can be completed.

Meanwhile, most banks have resisted upgrades to their core banking platforms and still rely on outdated functionality (such as daily batch processing) and manual or semi-automated processes, further slowing down payment processing. They also rely on nostro banking, which is a separate account that a bank holds in a foreign currency at another bank. Nostros are frequently used to facilitate high-volume foreign exchange and trade transactions, but cost around $1.5 billion to maintain – costs which can then be passed onto business customers.

All these challenges with B2B cross-border payments create profound issues for businesses.

High transaction costs

It can be several per cent on a transaction for businesses to move funds across borders, and in some cases up to 10x more expensive than a domestic payment. For example moving funds from South East Asia using Swift is typically 3-4% in foreign exchange fees and up to $30 in Swift fees.

Operational complexity

Cross-border payments can be more complex and time-consuming, requiring businesses to have the necessary resources and expertise to manage them effectively.

Slow settlement, impacting cash flow

Long settlement times can create significant pressure on liquidity, while a business can also lose out to fluctuations in exchange rates between the moment of transaction and settlement. While moving money between European countries is typically faster, moving funds in and out of regions like South East Asia and Africa can take up to five days.

Complex regulatory and compliance processes

Financial and data regulations are continually evolving and differ around the world, making it challenging to understand and adhere to compliance obligations.

Lack of transparency

Information about cross-border payments can be difficult to surface. This includes fees, processing times, progress to settlement, and reasons for payment failures. As such, it can be difficult to make informed choices.

Poor customer experience

Business customers who are faced with friction at the checkout, opaque costs or concerns over security may decide not to go through with the transaction, or not return to purchase again. And if their preferred payment choice is not available, they may not even start.

These pains are felt by enterprises and small businesses alike, but more profoundly by the latter. While almost three-quarters of large enterprises claim to be very or extremely satisfied with the cross-border payment solutions on the market, only 23% of small businesses share their positivity. Access to resources will be part of that – smaller businesses have less headcount and so less opportunity to navigate cross-border payments systems.

Opportunities to optimise cross-border payments for businesses

Any business can send and receive cross-border payments. What’s important is how you do it. By taking time to understand different payment methods and systems, businesses can benefit from faster settlement times, enhanced security, and lower operating costs. For example, in recent years, blockchains have emerged as an alternative to traditional bank and card payment networks.

Any improvements in a cross-border payments operation feeds into improved cash flow, which can be reinvested into the business to deliver further operational innovations; and support marketing, recruitment, product development and other core activities.

Here are some ways that B2B businesses can benefit from optimising their cross-border payments operation.

Opening new markets

By having access to a wide range of international payment methods, companies can expand into new markets and gain more business customers. They can also take different approaches to markets, such as leveraging local banks and banking networks, and prioritising payment methods that are popular with a specific business community. Businesses that provide a more convenient and reliable payment experience can expect to increase sales and build long-term customer loyalty.

Increased efficiency

Automation can significantly reduce the work involved in processing a cross-border payment. Tools such as smart-routing of payments, anti-fraud software and reconciliation reports can save time and money that would otherwise be lost on unnecessary delays or paperwork. By automating these tasks businesses can reduce operating headcount and costs, and be more confident of complying with financial regulations by mitigating human-errors.

Financial planning

Companies with access to FX data and fast methods of transferring money across borders can take advantage of optimal exchange rates. While transparent data on processing fees and settlement times arm financial teams with a more accurate oversight of their real-time and projected cash positions,

Cash flow

A major outcome of the benefits of lower costs is improved cash flow. Businesses can also improve their cash flow by selecting cross-border payment methods with fast settlement times.

5 trends shaping the future of B2B cross-border payments

Advances in technology and the adoption of innovative payment systems are likely to enhance the efficiency and speed of B2B cross-border payments. Automation, artificial intelligence and distributed ledger technologies, such as blockchain, have the potential to streamline the payment process, reduce manual interventions, and accelerate settlement times.

Here we look at five trends shaping the future of B2B cross-border payments.

1. The rise of B2B ecommerce

Though the vast majority of cross-border payments take place between businesses, the most innovation has happened in the B2C space, most notably with ecommerce. Businesses trading with each other are now looking for those same experiences and benefits, such as card-not-present transactions, personalised customer experiences, and integrations with other financial systems that automate accounting workflows.

Research from McKinsey estimates that nearly two-thirds of B2B companies across industry sectors already offer ecommerce capabilities. And that is set to grow. The B2B ecommerce channel will be valued at just short of $22 trillion by 2030, a 120% increase on today.

A lot of sales volume will go through digital marketplaces (eg Alibaba, Amazon Business, Upwork, ECPlaza) — the same research from McKinsey states that 60% of B2B buyers say they are open to purchasing on digital marketplaces, roughly the same percentage as those who buy from supplier-branded websites (64%).

As B2B ecommerce grows, payments will become increasingly important. While the sector can leverage many of the innovations built for consumer sites in the last decade, notably fraud prevention and subscription payment engines, they will also need unique solutions, especially for moving large quantities of money internationally.

2. Growth of blockchains and stablecoins

Juniper Research estimates that B2B cross-border payments on blockchains will account for 11% of the total B2B international payments by 2024. Driving adoption is the relative speed, security, transparency and lower processing costs. One study found that distributed ledger technology (DLT) and blockchain cross-border payments could save businesses $10 billion by 2030.

Stablecoins are likely to be the currency of choice for cross-border payments, as they overcome the volatility issue of other cryptocurrencies. Stablecoins, whose value is pegged to an underlying asset (often a fiat currency) have a collective market cap of approximately $129 trillion (at time of publication). Over $40 billion in trades are made every day using stablecoins, with settlements reaching approximately $7 trillion in 2022, surpassing volumes of major card networks like Mastercard and American Express.

Businesses can offer stablecoins as a payment method at the checkout, and as an intermediary currency to settle fiat currency pairs. The fiat currency is instantly converted to stablecoins, which is moved across the blockchain and then converted into the settling currency, nullifying the risk of currency conversion.

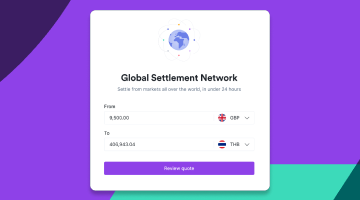

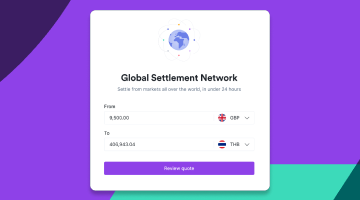

BVNK’s cross-border payment solution — Global Settlement Network — uses stablecoins to help merchants move funds from emerging markets and settle between currencies quickly and reliably. And Stripe, one of the world’s largest fintechs, now offers merchants the ability to make payouts in crypto through the stablecoin USDC, which is issued by crypto firm Circle. Visa is also exploring using the stablecoin USD Coin (USDC) and the Ethereum network for global settlements; while American Express has been working with Ripple since 2017 to process blockchain-enabled international B2B payments.

Despite the benefits of DLT, it’s unlikely that any business is ready to ditch fiat’s international payment rails entirely. Coexistence will be the norm, and with that the need for solutions that let consumers and businesses use ‘old’ and ‘new’ cross-border payment methods in tandem or interchangeably.

3. Incumbents will keep getting better

Swift will continue to build on its position as the primary international interbank network. As early as 2017 it launched Swift Global Payment Innovation (GPI), which promises same day cross-border transfers, transparent fees, and improved payment tracking. New services include Swift Go, a cross-border payments service targeted at small and medium-sized enterprises; and Payment Pre-validation, which uses predictive analytics to verify accounts before a payment is initiated. It is also looking into Central Bank Digital Currency (CBDCs) as a means for processing cross-border payments.

The major global card networks are also not about to give up their leading market position. Visa B2B Connect, launched in 2019, is a blockchain-enabled payment solution to facilitate global transactions between banks, without the need for a card; while Mastercard Send also leverages a private blockchain to enable near real-time cross-border payment transfers between billions of card, bank and digital accounts globally.

4. Fintechs to drive more innovation

B2B companies will turn to fintechs to create efficiencies in their cross-border payment operations. Here are three examples of how fintechs can support them.

- FX optimisation: Fintech solutions built on banking APIs will let company treasurers access real-time FX rates directly from existing systems, and so optimise when they execute payments and money transfers. This helps them to manage currency exposure, and automate reconciliation and settlements. More than 90% of B2B companies indicated that their organisation’s global expansion efforts could accelerate if they found an easier way to deal with foreign exchange rates.

- Virtual accounts: A virtual account provides clients with the flexibility to manage cash flow across currencies through a centralised account structure. Businesses can avoid the complexity of managing multiple accounts across different jurisdictions, and move money between entities more easily and cost-efficiently. For example, using BVNK Virtual Accounts, businesses can create multi-currency wallets, making it easier to send and receive payments and trade between currencies.

- Local acquiring: Having a local acquirer enables a business to offer customers local payment methods, which in turn generates higher approval rates because the payment is kept within a single banking network. Local acquirers can generate approval rates of up to 90%, compared with between 30-50% when using international acquirers are involved. Processing fees are also less.

5. Scalable payment platforms

B2B companies will increasingly invest in end-to-end platforms to switch on the cross-border payment optimisations they need. Platforms that provide native tools and third party solutions through a single API can automate away the complexity of running multiple payment solutions for specific tasks, such as account reconciliation and Know Your Customer (KYC). In turn businesses can redeploy resources to core activities.

What does the future hold for B2B cross-border payments?

In the next 10 years, there’s unlikely to be a single winner in cross-border payments. The market is growing and there’s space for multiple rails—old and new—which cater for different use cases, preferences and tolerances for risk, cost and speed.

Broadly, cross-border payments will be characterised by three types of infrastructure:

- There will be local payment rails that look to connect with each other. Progress here will be mixed, depending on the ambitions and know-how of regulators and organisations involved. India and Singapore have recently linked their digital payments systems, UPI and PayNow, to enable instant and low-cost fund transfers, with customers from eight banks able to benefit. In Latin America, work is underway to extend the success of Brazil’s Pix instant payment service to Chile, Ecuador, Colombia and Uruguay.

- Swift and other established international bank payment networks will continue to be significant. They are too entrenched and trusted to be dismissed. But businesses will be demanding more innovation. Swift gpi and Swift Go have been important steps forward in recent years, while Swift is also looking at new integrated services to support compliance, analytics, issue resolutions and record keeping.

- Blockchain-enabled cross-border payments will continue their rise. The business benefits—speed, security, transparency, accessibility—are too compelling to ignore. Progress will be faster in countries with high-levels of financial exclusion and low liquidity; and for low-value transactions and micropayments that were previously not feasible due to high transaction fees.

Exploring these opportunities will be a gradual process. With a period of coexistence, businesses will prize fintech partners that can help them orchestrate multiple cross-border payment rails in parallel, and quickly switch on new schemes as they emerge.

FAQs

How big is the cross-border B2B payments market in 2023?

Analysts estimate that $39.3 trillion of cross-border B2B payments will be made in 2023, and reach $56.1 trillion by 2030.

What are some reasons why B2B cross-border payments take place?

The main reasons why B2B cross-border payments take place are for buying and selling on B2B ecommerce sites; paying international suppliers, software subscriptions and salaries of international staff, institutional investments and currency trading; repatriating funds; and treasury departments moving funds around an organisation.

What is risk in cross-border payments?

Risk in cross border payment methods is defined in a number of ways. Businesses are at risk of payments failing, long settlement times, costly processing fees, poor payment experiences and complex regulatory obligations. These risks can impact cash flow and market competitiveness.

How big is the B2B ecommerce market?

Nearly two-thirds of B2B companies across industry sectors already offer ecommerce capabilities. The B2B ecommerce channel will be valued at just short of $22 trillion by 2030, a 120% increase on today.

What are some examples of global B2B ecommerce sites?

Some examples of global B2B ecommerce sites are Alibaba, Amazon Business, Upwork, and ECPlaza.

What is Swift?

Swift (the Society for Worldwide Interbank Financial Telecommunications) is the primary network for moving money internationally, with 11,000 member institutions worldwide and facilitating $150 trillion in transactions per year.

How is blockchain used in cross-border payments?

Blockchains are used in cross-border payments in a number of ways. Cross-border payments can be made directly on-chain if the transaction is being initiated and settled in the same cryptocurrency. Blockchains can also be used as an intermediary tool to process cross-border fiat payments. The payer’s fiat currency is transferred for a cryptocurrency, sent across the relevant blockchain, and converted to the payee’s preferred fiat currency for settlement. Stablecoins are often used for this because they are less volatile.

How many B2B cross-border payments are made using blockchains?

Juniper Research estimates that B2B cross-border payments made on blockchains will account for 11% of the total B2B international payments by 2024.

What is MiCA?

MiCA (Markets in Crypto-Assets) is an EU regulation covering cryptocurrencies and virtual assets. It was approved on April 20, 2023, by the EU Parliament and is set to become law in 2024.

What are the advantages of using fintech networks for cross-border payments?

The benefits of using fintech networks for cross-border payments include automatic rerouting of payments to identify the fastest and most effective settlement path; real-time information about the progress of the payment; ease of integration with other services and software tools, such as FX; management of compliance obligations; and enhanced customer support.

Conclusion

The future of B2B cross-border payments is expected to be dominated by digital payment solutions that offer faster, cheaper, and more secure transactions. Additionally, there is a growing trend towards API-driven payment solutions that enable businesses to easily connect with multiple payment providers and streamline their payment processes. This all points to greater automation, improved transparency and more efficient payment processing.

For most businesses, trusted legacy systems and deep-rooted behaviours will mean a period of coexistence between traditional banking payment rails and new alternatives. But it will not be long before the evidential advantages of emerging cross-border payment technologies will make their widespread adoption inevitable. Of those battling for dominance, DLTs and blockchain payments have most to offer, especially where stablecoin currencies are used.

Businesses keen to explore the opportunities of cross-border payments have much to consider. Fintechs will provide an increasing important role in helping them to navigate and enable the necessary tools. Fintechs that can orchestrate multiple service providers from a single, scalable platform will be in a strong position.

Unlock faster settlement with distributed ledger technology

Latest news

View allGet payment insights straight to your inbox

.avif)

.avif)

.avif)

.avif)