Foreword

The decade that money became more efficient

By Ben Reynolds, MD – US, BVNK

2024 marks the 10 year anniversary of stablecoins: the digital currency that combines the accessibility, speed and transparency of the blockchain, with the stability of major fiat currencies. Stablecoins connect buyers and sellers around the world in an instant, and function uniquely as the only truly global currency in operation today. They’ve become the world’s ‘digital dollars’, since the vast majority are pegged to the US dollar.

In the last decade, we’ve seen their steep growth, reaching a market cap of $165 billion in July 20241, and representing trillions of dollars in transactions a year. They’ve taken on a multitude of traditional money functions, including payments. In many countries, they act as a digital, tokenised version of cash. In others, they power financial markets.

We’ve also seen governments and regulators formally recognise stablecoins as a regulated financial asset, with Europe the first major market to roll out a comprehensive, cross-jurisdictional regulatory regime for digital assets, including stablecoins.

For businesses, stablecoins represent a new way to move money globally at internet speed. While to consumers, cross-border payments today might feel instant, the underlying rails are often not. Most were built decades ago and rely on closed systems of intermediaries. Stablecoins act as a new base layer for payments, enabling money to move securely, 24/7/365, and settle in an instant.

To those of us who work with stablecoins every day, the efficiency gains are clear. But to our knowledge, there is no existing comprehensive analysis of these gains. We’ve partnered with the Centre for Economics and Business Research (Cebr) to address that. This report demonstrates for the first time the quantitative link between increasing stablecoin use and economic impact. It considers impact in three areas: mitigating the costs of currency volatility, bridging the dollar gap, and releasing capital trapped in slow payment systems.

To understand what that looks like in the real world, as well the challenges ahead in realising all of that value, we’ve drawn on the expertise of industry leaders including stablecoin issuers Circle and First Digital, blockchain data firm Chainalysis, payments industry leader Visa. Thank you to everyone who has openly shared their data and insights.

On the eve of this 10 year anniversary of stablecoins, we hope this research adds to the ongoing conversation, and provides a new way to think about the growing opportunity in front of us, to enable global payments at internet speed.

Introduction

A payments layer for the internet era

Stablecoins were designed to bring stability and predictability to crypto, addressing a major drawback of digital currencies like bitcoin: high volatility. Fluctuating prices make most cryptocurrencies difficult to use for everyday transactions.

Asset-backed stablecoins help solve this problem by pegging their price to a more stable asset, typically a fiat currency. Some stablecoins have broken their peg in the past and stablecoin value is not guaranteed, but in most past cases of 'depegging’, the peg has been restored within a few days.

Crypto traders were early adopters, moving their funds into stablecoins to avoid the volatility of other cryptocurrencies, without having to leave the crypto market entirely. This was especially useful on crypto exchanges that didn’t enable you to trade your crypto for fiat.

In the last decade, stablecoins have found other important uses: as a store of value in countries with volatile currencies, and as a way to send payments across borders. Though today they make up only a fraction of the global financial system, they are fast becoming a popular way to transfer value globally, with major players like Visa investing in the technology.

Charting the growth of stablecoin payments 2020-2024

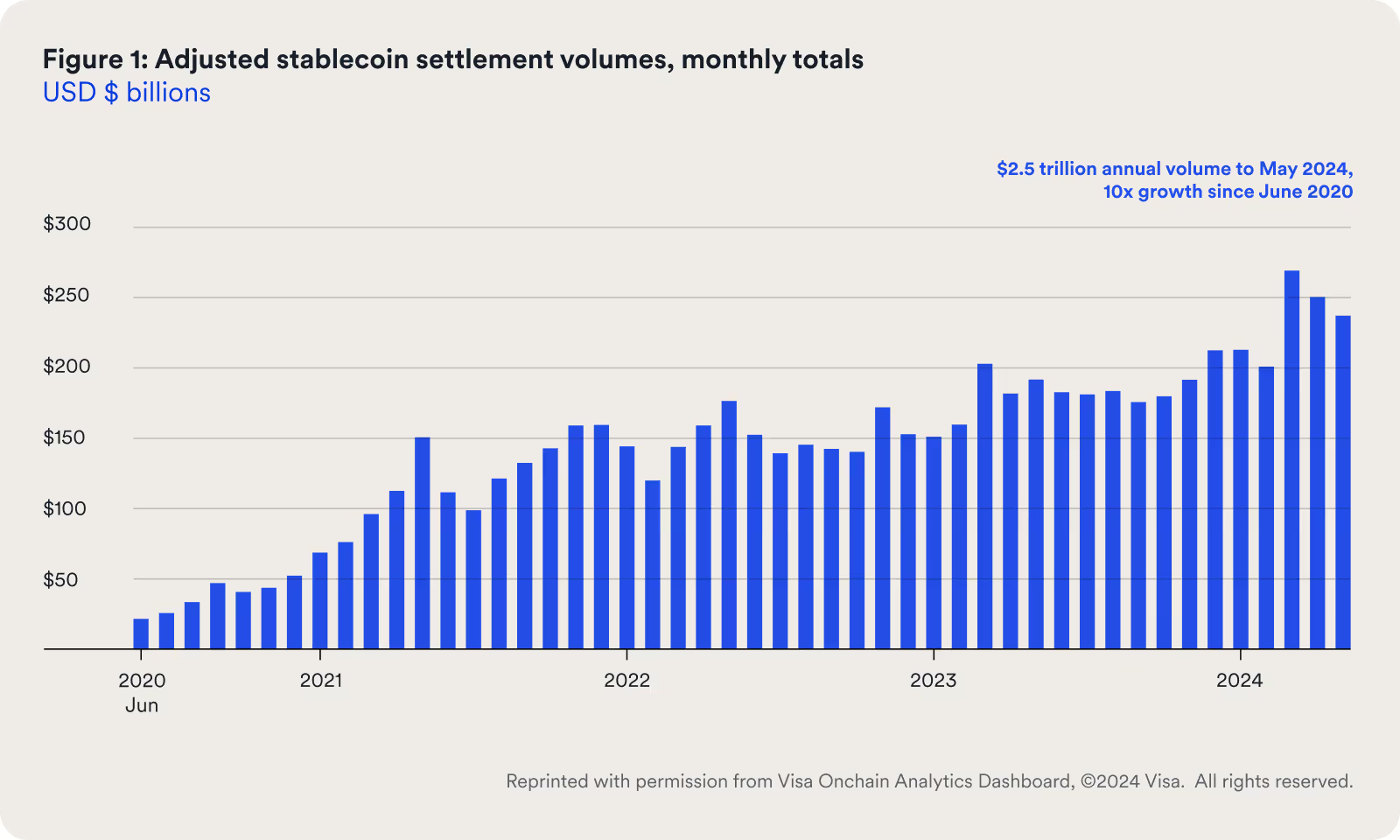

For a fuller picture of stablecoin adoption in payments, we examined two key data points: the volume of stablecoins settled on blockchains, and the number of active stablecoin wallet addresses (asa proxy for users).

- Stablecoin settlements have shown strong growth through crypto market cycles. Total settlement volumes reached almost $7 trillion in 20232 according to Coinmetrics, with Tether’s stablecoin USDT accounting for approximately two thirds.

- New estimates in 2024 from Visa’s Onchain Analytics Dashboard aim to isolate payments usage within this volume, stripping out activity associated with high-frequency trading, high-volume institutional money movement, smart contract intermediaries, and other smart contract to smart contract transfers.

- Even with this narrower lens applied, $2.5 trillion of stablecoins payments were settled in the 12 months to May 2024, and volumes have grown 10x since June 2020.3

- These volumes are significant in the context of other major payment networks. According to Statista, PayPal settled $1.5 trillion in 20234, and Mastercard reported volumes of $9 trillion5.

- The number of active stablecoin addresses has also shown strong growth, increasing 15x from July 2020 to May 2024, with an average of 220,000 new addresses a month over that time.6

As stablecoin adoption scales, economic output will increase

Stablecoins bring the full utility of the internet to bear on payments, creating a new base layer where money can move globally near instantly, where marginal costs can be reduced and where transactions can become programmable.

This report covers three key areas of economic impact we see today: mitigating the costs of currency volatility, providing global access to a digital form of the US dollar, and releasing working capital trapped in cross-border payment systems.

Though not the focus of our analysis here, there is also potential for new forms of native, interest-bearing stablecoins to create significant economic impact in the future.

We’re in the early stages of development of this internet financial system, but as the adoption of stablecoins increases, we expect to see economic output accelerate. This report aims to give a sense of the nature of that economic output and its magnitude.

Cebr’s approach to assessing stablecoin use

The analysis in this report was carried out by Cebr between April and June 2024. It uses adjusted stablecoin payments volumes from Visa, new data from Juniper Research on the geographic breakdown of B2B cross-border payments, data from Chainalysis on the percentage of stablecoin outflows by country, combined with analysis from the Centre of Economics and Business Research (Cebr). There are some limitations to this approach, which we acknowledge:

- It’s important to understand the absolute numbers for both active addresses and payment volumes maybe underestimated due to the methodologies applied, which are designed to isolate payment activity. These methodologies exclude certain high-volume custodial or hosted addresses and high-transaction addresses. Specifically, the methodologies exclude addresses with over 1000 stablecoin transactions per month or with over $10,000,000 in stablecoin volume per month. This exclusion removes volume from payment providers like BVNK who process billions in stablecoin payments for their clients. Additionally, high-volume and high-transaction count activity from central exchange addresses like Coinbase are excluded, which may represent a significant number of retail stablecoin users.

- The analysis presented here is anchored to volumes in the Visa dataset and has considered this volume as payment settlements, findings are therefore conditional on this heuristic approach.

- It's challenging to pin a location to a transaction recorded on the blockchain. ‘Top-down’ approaches that begin with total settlement numbers don’t speak to the geographic distribution of stablecoin use. This report has benefitted from access to Chainalysis data that partners web traffic usage and fiat/stablecoin trades to build a geographic distribution of stablecoin use. This has been synthesised with survey-based methodologies from Juniper Research to form estimates used in the report. An element of judgement has been used in the synthesis of these two evidence bodies.

- Given the direct link between the magnitude of stablecoin use and the magnitude of economic impact, uncertainty in the former should be acknowledged. Inferences pertaining to themes, trends and growth can be made despite these limitations. The value of this report is in demonstrating (to our knowledge for the first time) the quantitative link between increased stablecoin use and economic impact.

Key findings summary: 3 economic impacts

Mitigating the costs of currency volatility

- Currency volatility negatively impacts economic performance in emerging economies. Total GDP losses due to long-term currency volatility in the 17 countries studied by Cebr are $1.2 trillion – or 9.4% average of GDP. GDP losses are particularly significant in Indonesia ($184bn) and in Brazil ($172bn).

- Stablecoins offer a strategy to mitigate some of this loss, by providing a form of value and exchange pegged to a stable fiat currency – typically the US dollar.

- For individuals, this helps to protect savings from the impact of devaluing currencies and gives more purchasing power. For businesses, it protects the balance-sheet, avoids the risk of damaging commercial contracts that lock in unfavourable pricing, and supports financial planning.

Bridging the dollar gap

- The US dollar is stable, widely-accepted and dominates global commerce. It was on one side of 88% of all foreign exchange trades in 20227 and accounts for over 40% of cross-border payments.8

- As a digital substitute for the US dollar, stablecoins fulfil global demand for a stable currency where access is limited. Like fiat dollars, stablecoins are designed to hold their value. But unlike fiat dollars, they can be sent around the world near-instantly, operate 24/7/365, accessed with just an internet connection, and bought and sold easily.

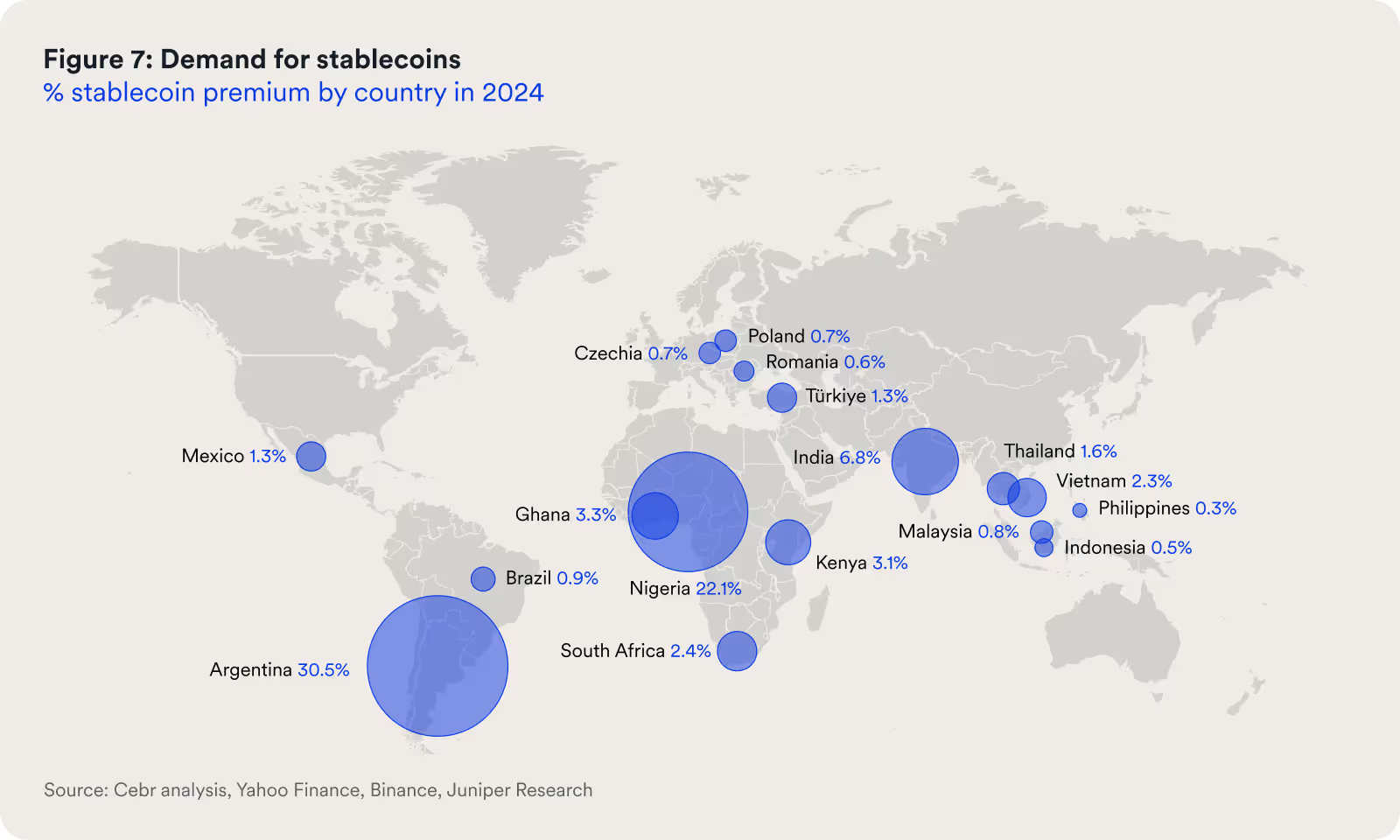

- Our research identified significant demand for stablecoins in emerging economies in the form of a 'stablecoin premium’. Businesses and consumers in 17 countries studied pay a premium to access stablecoins: on average 4.7% more than the standard US dollar price, rising to 30% in countries like Argentina. In 2024, it’s estimated these 17 countries will pay $4.7 billion in premium alone to access stablecoins, rising to $25.4 billion by 2027.

Releasing capital trapped in payment systems

- Today’s cross-border payment systems are associated with long delays in moving funds, trapping capital in-transit and requiring financial services providers to hold capital in pre-funded accounts to mitigate risk.

- In 2024 there will be $40.1 trillion cross-border B2B payments9 made via these slow payment rails (excluding wholesale). We examined 4 major B2B routes with settlement delays: at any given moment, $11.6 billion of working capital is trapped there. This capital is idle and unavailable for growth, representing a significant opportunity cost for businesses.

- Already, stablecoins have begun to speed up global settlement. A straight line projection suggests that in 2024, there will be $2.8 trillion cross-border stablecoin payments globally, reducing the time between payment settlement times by up to 3-6 days across our 4 routes.

- For businesses, getting access to funds sooner improves liquidity and efficiency, and reduces the costs of borrowing. Our analysis found that when these funds are used productively, they generate a $2.9 billion return for businesses by 2027 across the 4 routes (representing c.10% of total cross-border payments volume).

- Though capital held in pre-funded accounts is not the focus of our analysis, older estimates put this at more than $5 trillion.10 By enabling near instantaneous settlement, stablecoins bypass the need to pre-fund accounts in correspondent banking corridors, potentially releasing this capital.

Impact 1

Mitigating the costs of currency volatility

A volatile currency can negatively impact an economy’s performance, creating heightened uncertainty for businesses, destabilising inflation and making it more difficult to access financing. These factors typically lead to less investment, which dampens current economic activity, as well as future growth.

Currency volatility creates the following problems for businesses:

- Cost uncertainty: Exchange rate volatility can unpredictably alter the cost of imported raw materials. This significantly impacts a firm’s production costs, pricing, and international competitiveness. Stablecoins enable more accurate and reliable financial planning: better predictability boosts investment, employment and broader economic growth.

- Damaging contracts: Long-term international contracts can become detrimental to a business, if the domestic currency loses value significantly. Holding stablecoins mitigate this risk, enabling businesses to engage with international markets and making it easier to price contracts.

- Access to financing: Currency volatility can lead banks to perceive businesses as high risk, raising the cost of borrowing and reducing investment opportunities. Stablecoins can stabilise revenue and reduce uncertainty in forecasting. This reduces loan risk and therefore lowers the cost of borrowing, and creates investment opportunities.

Longterm GDP losses in emerging economies

We assessed the long-term cost of currency volatility on economic growth for 17 countries and found total GDP losses of $1.2 trillion – or 9.4% of GDP on average between 1992-2022. GDP losses are particularly significant in Indonesia ($184bn) and in Brazil ($172bn).

Stablecoins offer a strategy to reduce these costs with a method of exchange pegged to major fiat currencies like the US dollar, which see little fluctuation in price compared to the emerging market currencies studied.

Cebr’s approach to measuring the cost of currency volatility

- Cebr has constructed a proxy of currency movements following the methodology of Ameziane and Benyacoub (2022). Then an econometric method is used to capture quantitatively just how much the currency fluctuates month-on-month against major trading partners, this is aggregated to form an indicator of currency volatility on a yearly basis.

- To estimate the long-term impact of volatility on GDP-per-capita growth, periods with significant increases in volatility were identified. The negative long-term relationship between volatility and growth identified in the literature is used to project economic impacts to impute the GDP lost, relative to no-volatility counterfactual, over the period. Note: the period of analysis for Czechia is 1995-2022 as the country was not formed until 1993.

Industry perspective: Chainalysis

Global utility is powering the rise of stablecoins

Kimberly Grauer, Director of Research at blockchain data firm Chainalysis, sums up stablecoin adoption trends.

“While major cryptocurrencies like bitcoin dominate the headlines, stablecoins have surpassed all others in usage. Their prominence in transaction activity show the high levels of utility they offer. They continue to play a pivotal role in broader adoption of crypto for everyday transactions outside of trading.

The purchases of stablecoins using local fiat currency is a good proxy for global usage, and the rising volumes show that stablecoins are becoming a true global asset.

If you look at those numbers as a proportion of GDP, you see clear hotspots of adoption. While the US and the EU are still well-represented, emerging markets like Turkey, Thailand, and Brazil are leading the way in stablecoin purchasing as a share of national GDP. Residents in these countries frequently turn to stablecoins to preserve their savings when the local currency loses value.

With the rise of the global digital economy, growing international adoption of stablecoins demonstrates their essential role in enabling financial inclusion and facilitating entry into the global market for the unbanked or underbanked.”

Impact 2

Bridging the dollar gap

The ‘stablecoin premium’: what businesses are willing to pay for access to stablecoins

As a digital substitute for the US dollar, stablecoins fulfil global demand for a stable currency where access is limited. Like fiat dollars, stablecoins are designed to hold their value. But unlike fiat dollars, they can be sent around the world near-instantly, operate 24/7/365, accessed with just an internet connection, and bought and sold easily.

Our research shows people and businesses in the countries studied are willing to pay more to hold and trade in US dollar stablecoins than fiat US dollars. We call this the ‘stablecoin premium’.

On average, businesses and people are prepared to pay a premium of around 4.7% for access to stablecoins, rising to 30% in countries like Argentina. In 2024, it’s estimated these 17 countries will pay $4.7 billion in premium alone to access stablecoins, rising to $25.4bn by 2027.

US dollar-pegged stablecoins are more valuable than dollars in the emerging markets studied. What might drive this? We consider three sources of demand:

Demand 1: Access to financial services

Problem of access

Around 1/4 of the world’s population is still unbanked, with World Bank research11 suggesting that increasing electronic payments, internet access and mobile phone usage can improve financial inclusion.

Stablecoin as the solution

Stablecoins allow anyone with an internet connection to access a stable currency, without the need for a traditional bank account. This is a mechanism to improve global financial inclusion, while the low barrier to entry also supports a demand premium.

Demand 2: Access to dollars

Why global demand for dollars?

Holding dollars acts as a hedge against local currency movement for businesses. It also opens up international trade which is predominantly conducted in dollars.

Problem of access

Access to US dollars and other global currencies is facilitated by a network of correspondent banks and payment companies. This can lead to long chains of friction reducing transaction efficiency and increasing cost. At points along this chain, third party risks, burdensome regulation or bad actors can constrain access altogether.

Stablecoin as the solution

The majority (>99% by market capitalisation12) of stablecoins are dollar-pegged. This gives businesses and individuals globally access to the world’s reserve currency, even where access to traditional fiat dollars is problematic. The premia to an extent reflects additional demand for dollar-equivalent access where access to traditional dollars is constrained.

Demand 3: Access to dollars at a fair price

Price distortions

Constrained supply of fiat dollars and fragmented local markets means that the price of dollars in local markets can reach exorbitant levels, precluding access at ‘official’ exchange rates.

Stablecoins as the solution

Stablecoins can be bought and sold easily, requiring only access to the internet. This means markets can be less fragmented and consequently deeper than the market for physical dollars. Although the stablecoin price can exceed the official fiat price, this may be a result of, or even evidence of, consumers and businesses facing higher prices for fiat dollars on local markets.

Cebr’s approach to measuring the stablecoin premium

- We studied 17 countries to measure the stablecoin premium: Argentina, Brazil, Czechia, Ghana, India,Indonesia, Kenya, Malaysia, Mexico, Nigeria, Philippines, Poland, Romania, South Africa, Thailand, Turkey, Vietnam

- Using the price of USDT as representative of a dollar-pegged stablecoin, we look at various historic USDT prices across multiple crypto exchanges that enable a variety of fiat currencies to be traded against USDT [1].

- We then calculate the percentage premium of this price over and above the price of buying USD in the same fiat currency [2]:

𝐴𝑐𝑐𝑒𝑠𝑠 𝑝𝑟𝑒𝑚𝑖𝑢𝑚 (%) = (USDT Price / USD Price − 1) ∗ 100

- Since this premium is an extra amount paid by businesses and individuals to hold and trade in stablecoins. We can calculate the total amount already being spent on access stablecoins with the following equation:

𝑀𝑎𝑟𝑘𝑒𝑡 𝑣𝑎𝑙𝑢𝑒 𝑜𝑓 𝑎𝑐𝑐𝑒𝑠𝑠 𝑡𝑜 𝑠𝑡𝑎𝑏𝑙𝑒𝑐𝑜𝑖𝑛 = 𝐴𝑐𝑐𝑒𝑠𝑠 𝑝𝑟𝑒𝑚𝑖𝑢𝑚 ∗𝑋𝐵 𝑝𝑎𝑦𝑚𝑒𝑛𝑡𝑠 [3]

[1] Luno: Indonesia, CoinDCX: India; Data provided by BVNK includes Ghana, Kenya, Vietnam, Malaysia, Thailand; All other price data is from Binance. Fiat pairings price data is from Yahoo Finance.

[2] To inform the estimates in this section we have taken the YTD average premium for 2024 where available. In Malaysia, data limitations have meant we have used the average premium in 2023.

[3] Data limitations have meant in Turkey, Indonesia and Turkey payment flows were not decomposed between inflows and outflows. In these countries an estimate of total stablecoin cross-border payment volumes is presented, elsewhere stablecoin cross-border payment outflows are used.

Case study: Fintechs

Fintechs bringing the value of stablecoins to market

Here, we highlight a selection of interesting fintechs in the stablecoin payments space.

Yellowcard is a pan-African fintech offering trading, remittances and an API for business payments in stablecoins. The economic impact is trifold: bringing access to the dollar, diminishing the cost to businesses of uncertainty, and allowing for streamlined payments, unlocking working capital.

Oval Finance provides institutions and businesses across Africa with global treasury management and cross-border settlement via stablecoins, unlocking working capital for businesses operating in the continent.

Félix is a Miami-based fintech that allows users to send cross-border payments from the US to Mexico with an interface embedded in WhatsApp. They offer lower fees and faster transfer times via stablecoin. Remittance flows into Latin America and the Caribbean were $156 billion in 2023.13

DolarApp operates in the US/Lat-Am corridor, streamlining remittance flows and cross-border movement of money with stablecoins. This again unlocks working capital for businesses and supports access to US dollars.

Sling Money uses stablecoins to enable almost instant money transfers, in any currency, for a negligible fee. Sling provides users with self-custody blockchain wallets, where funds are held in USDP, issued by Paxos. Sling is available in 25+ countries and available in the Android and iOS app stores.

Cedar Money was founded in 2022 and is a blockchain-based platform that simplifies cross-border payments for businesses in Africa. The fintech enables businesses to send high-volume payments to international suppliers at affordable rates, by leveraging digital currencies including stablecoins.

Industry perspective: Circle

Stablecoins put dollars to better use, and should be measured by their ability to redeem

Andrew Gallucci, Director of Regulatory Strategy at Circle covers what’s driving the growth of USDC, why a stablecoin’s worth is measured by the ability to redeem it, and why MiCA is good news for stablecoins in Europe.

Circle’s mission is to raise global economic prosperity through the frictionless exchange of value. In 2018 it launched US-dollar backed stablecoin, USDC, now the second largest by market cap. The issuer is known for its regulatory-forward approach and is set to become the first stablecoin issuer to be licensed under the MiCA regime in Europe in 2024.

So what’s driving adoption of stablecoins like USDC? “It boils down to the fundamentals that make this technology superior to traditional centralised finance,” says Andrew Gallucci, Director of Regulatory Strategy at Circle. “Those are: accessibility, speed and interoperability. Attributes that, in different contexts, offer concrete advantages to legacy financial services.”

Accessibility is key in regions like Latin America where USDC – as a tokenised version of cash – offers both a safe store of value and is readily transferable, says Gallucci: “Anywhere the dollar is being used, USDC can act as a digital version, and a way to extract more value in commerce.” Of the $2.2tn in cash circulating globally, 80% is currency held in $100 bills, says Gallucci, which reflects that this cash is predominantly being used as a store of value. “Stablecoins bring more of that cash to economic use.”

The need for speed in financial markets

In countries like the US, the fast-settling nature of stablecoins makes them useful for financial markets, says Gallucci: “In the US, the SEC recently required a T+1 timeline for settling securities transactions, but that’s still one long day away from what stablecoins offer.” Stablecoins also act as “the grease between the gears” of short term money markets, says Gallucci, “a way to move in and out of funds near-instantly, whether during trading hours or over the weekend.”

Instant settlement is critical in FX markets too. Of the $6-7 trillion in global daily FX transactions, a third are subject to settlement risk. Gallucci explains: “Someone either has to front the money and be exposed to a fluctuating currency or expose themselves to risks that a counterparty won’t pay.” In these contexts, many businesses resort to pre-funding, or keeping capital reserves. “Some of these simple but pervasive risks can go away with payment-versus-payment settlement,” says Gallucci, where the simultaneous and irreversible transfers of funds can be programmed to automatically execute when conditions of a smart contract are met.

Rethinking cross-border payments

Cross-border payments are a key driver for the adoption of USDC. “There's an enormous remittance market and demand for affordable cross-border payments in the U.S.,” says Gallucci, “that’s where all of these benefits come into play. People are able to send money easier, faster, and cheaper, all with broader accessibility to people across the world that need only an internet connection.”

Creative opportunities for programmable payments

Outside of better known use cases, there are many businesses using stablecoins to solve local problems creatively, adds Gallucci.

“It gets exciting when you apply programmability to payments. For example, I recently spoke with a Kenyan company offering agricultural seed insurance to farmers that incorporates local weather data into smart contracts to enable automated insurance payouts using USDC. There are also remittance companies programming USDC payments that can be used to cash out only for medical supplies at a pharmacy…. We’re really only scratching the surface of how stablecoins will be used.”

Operating in the grey, and the impact of MiCA

One of the biggest challenges to stablecoin adoption remains lack of regulatory clarity. Circle’s approach is to openly engage, says Gallucci: “There isn’t a regulator in the world that will take kindly to sneaking through the back door to offer financial services…. if you operate in a grey space, you need to walk through the front door and work with regulators.”

Europe’s MiCA framework is an example of what can happen when regulators act proactively, adds Gallucci: “It’s light years ahead of many other jurisdictions and creates a path for regulated stablecoins to be treated as e-money in the EU.” Because of it, we’ll see more adoption from traditional financial institutions, says Gallucci, but also from big corporates: “There are also a lot of Fortune 500-level companies waiting for clarity. MiCA will be a real catalyst for innovation that we hope other policymakers particularly in the US will emulate.”

As more players enter the space, competition will drive value for consumers, adds Gallucci, pushing financial services players to innovate. But could regulation dampen the value of stablecoins by driving up fees? Gallucci says it depends on how regulators regulate. “Blockchains are open, permissionless infrastructure – a medium for information exchange, like the internet – and should be regulated as such… When it comes to mass adoption, we’re still in the ‘dial-up’ phase and the technological aspects of the user experience will need to fade to the background. We’re seeing a movement towards abstracting things like fees away from users as has happened with other types of payments.”

Redemption is the bottom line

In a world still dominated by fiat currencies, the worth of a stablecoin is measured by its ability to redeem it, says Gallucci. “We've seen a number of crypto implosions in the last few years, which came down to a lack of stability at the point of redemption. At Circle, we’ve come out of the last few years and doubled down on building a global banking and liquidity network that allows us to on- and off-ramp funds in all corners of the globe. This is the bedrock of any long-lasting stablecoin.”

Case study: BVNK

Near instant payroll for a global workforce

In 2024, BVNK launched a new product, built in collaboration with a major global HR platform, to enable near-instant payments for a globally disparate workforce, via stablecoins. In the first few months, 7,600 contractors paid by this HR platform, opted to be paid in stablecoins, with $25 million paid out.

Accelerated by changing working practices during the COVID-19 pandemic, remote working has increased significantly in recent years, with this trend expected to continue. The World Economic Forum estimates that there will be 92 million specifically global digital jobs by 2030, an increase of over 25% on current levels.

These trends bring increasing complexity for institutions managing global payroll. Specific challenges include controlling against exchange rate movements and the associated impact on budgeting, managing the risk of cross-currency transaction fees and paying staff quickly. From the perspective of employees, challenges are similar: receiving and accessing wages without significant delays and ensuring that the ‘correct’ wage is received in the agreed currency.

As ‘digital dollars’, stablecoins can prevent these challenges, mitigating exchange rate risks and preventing delays associated with traditional cross-border payment rails. This has implications for easier budgeting and financial planning, stabilising paycheck values and providing more certainty for employers and employees.

Impact 3

Releasing capital trapped in payment systems

Payment systems struggle across borders

Payment systems like Swift, correspondent banking, and standard 9-5 domestic banking, are often associated with long delays in the transfer of funds. By comparison, stablecoin payment rails can significantly reduce the time between a payment being debited from the payer's account and credited to the payee's account, known as the payment float time.

Traditional payment systems are a two-stage process: clearing and settlement:

- Clearing involves the payer's bank first vetting and recording the transaction for compliance with local anti-money laundering and fraud regulations before instructions for the fund transfer can be sent through a network of intermediary banks to the recipient's bank. The recipient's bank must then also clear the transaction for regulatory compliance.

- Settlement is the actual transfer of funds to the payee at the end of this process.

Making international transfers using stablecoins is more streamlined:

- The sender simply transfers the stablecoin directly to the recipient's wallet address.

- The transaction is vetted and approved by the blockchain network through a consensus mechanism. Once confirmed, it’s permanently recorded on the blockchain, ensuring transparency and security. The transaction is vetted and approved by the blockchain network through a consensus mechanism. Once confirmed, it’s permanently recorded on the blockchain. Note that stablecoin payment providers are subject to similar AML regulations as those that apply to fiat, so AML checks can add time to settlements. Regardless, the transfer is typically processed within minutes, as opposed to days.

If the recipient wants to convert stablecoins into local fiat currency, they can transfer stablecoins to an exchange, sell for local fiat currency, and withdraw the funds to their bank account. Timing varies by provider and the currencies involved, but BVNK for example typically settles its clients in major currencies within 24 hours.14

The problem of trapped working capital

In 2024 there will be $40.1 trillion15 cross-border B2B payments made via traditional payment rails (excluding wholesale B2B payments).

We examined 4 major B2B routes with settlement delays and found that at any given moment, $11.6 billion of working capital is trapped between these regions. While trapped, this capital is idle and unavailable for growth, representing a significant opportunity cost for businesses.

The value of releasing in-transit capital

Already, stablecoins have begun to speed up global settlement. A straight line projection from current figures suggests that in 2024, there will be $2.8 trillion cross-border stablecoin payments globally. On the routes studied in this report, stablecoin settlement gave businesses access to their funds up to 3-6 days sooner.

This improves liquidity for businesses, reduces the costs of borrowing, enhances operational efficiency and makes funds available for growth sooner. When these funds are used productively, they generate a $2.9 billion return for businesses by 2027 across the 4 routes studied (these routes represent around 10% of total cross-border payment volume).

Stablecoins may release more than $5tn of capital from pre-funded accounts

To enable quick money movement through the correspondent banking system, financial institutions pre-fund accounts with one another, keeping liquidity in the system so money can be drawn between institutions to meet demand.

Stablecoins may reduce the need to hold these funds, representing a secondary, potentially larger release of capital beyond the faster payment times discussed in this section.

What does this capital do?

Prefunded accounts refer to Nostro/Vostro bank accounts. Nostro (ours) and Vostro (yours) are the same accounts from the perspective of each of two banks. Funds sit there to be accessible in the case of unexpected outflows.

This capital is ringfenced for future payments and so banks can’t use it for more productive purposes. This opportunity cost is the real economic effect of these funds sitting in pre-funded accounts.

How much is there?

- In 2018 Brad Garlinghouse Ripple CEO said “somewhere in the order of magnitude of $10tn” is held in these accounts.16 Ripple also gives an estimate of $5tn at the end of 2018.17

- Under a wider definition of “transactional accounts” (which will include non-cross border payments), the McKinsey Global Payments reports estimated that at the end of 2015 there was $27tn in these accounts worldwide.18

How much will stablecoins release?

- Stablecoins can enable near instantaneous settlement, bypassing the need to pre-fund accounts that make up correspondent banking corridors. This kind of efficient underlying payment system may dramatically reduce the need for the excess buffers in pre-funded accounts.

- The full magnitude of this effect will depend on the regulatory treatment of stablecoins and other drivers for the need for liquidity. It is unlikely that all this capital would be put to other uses. Liquidity requirements mean financial institutions need to maintain buffers to cover 30-day stress tests: balances in nostro/vostro accounts may help in meeting these regulations.

Cebr’s approach for measuring the impact of releasing of working capital

We calculate:

- The opportunity cost that is avoided by the current level of stablecoin usage for making cross-border B2B payments, as well as the amount projected to be avoided by 2027 if current adoption trends continue.

- The opportunity cost of 100% of cross-border B2B payments currently made through traditional correspondent banking, like Swift, not using stablecoins as a bridge;

- The opportunity cost of 100% of cross-border B2B payments currently made through correspondent banking not being settled directly in stablecoins.

The same framework is used to make these three estimates. We first calculate the daily float that we estimate to be ‘trapped’ in the financial system from making payments between each country on our routes of interest, using data from Juniper Research and Visa / Allium.

In (a) this is Cebr’s estimate of daily stablecoin volumes, while in (b) and (c) this is Cebr’s estimate of daily non-stablecoin volumes. We then multiply these volumes by Cebr’s estimate of the average daily real interest rate in each recipient country, taken to the power of the number of days of float time which are (a) currently saved by using stablecoins; (b) could be saved if stablecoins were used as a bridge; and (c) could be saved if payments were settled directly in stablecoins.

This reflects the opportunity cost of this idle capital to businesses when making payments between each country pair. We aggregate these figures to full-year and multi-year costs for each country, then aggregate these for all countries on the routes of interest.

Note that the opportunity cost estimates are the additional economic output that (a) is supported by current use, or (b) and (c) could be supported by further use of stablecoins. The ‘amount of trapped capital released’ is the cumulative value of businesses’ daily floats, i.e. transaction volumes, rather than an economic impact such as an opportunity cost or GDP uplift.

Case study: Visa

Visa enables stablecoin settlement in USDC for issuers and acquirers

In March 2020, Visa became one of the first major payments networks to launch a pilot programme enabling clients to settle cross-border transactions in USD Coin (USDC). The pilot enabled Crypto.com, one of the world’s largest crypto platforms, to send USDC to Visa, to settle a portion of its global settlement obligations for its Visa card programmes.

As part of Visa’s Digital Currency Settlement pilot, Crypto.com sends USDC cross-border over the Ethereum blockchain to Visa.

“This settlement process is a leap forward for the payments industry,” said Kris Marszalek, CEO of Crypto.com in a previous case study with Visa, “it allows for faster and more reliable transactions that are backed by the blockchain and can be done anytime and from anywhere, without currency conversions.”

Cuy Sheffield, Head of Crypto, Visa, commented: “By leveraging stablecoins like USDC and global blockchain networks like Solana and Ethereum, we're helping to improve the speed of cross-border settlement and providing a modern option for our clients to easily send or receive funds from Visa’s treasury. Visa is committed to being on the forefront of digital currency and blockchain innovation and leveraging these new technologies to help improve the way we move money.”

In 2023, Visa extended the pilot to merchant acquirers who serve a growing number of web3 businesses including on-ramp providers, games, and NFT marketplaces. This enabled acquirers to receive settlement payouts in USDC and send USDC to their own merchants over the Solana and Ethereum blockchain networks.

Case study: Worldpay

From merchant settlement to consumer payouts.

Worldpay has been involved in the crypto space for the past decade: initially, as a payment processor for crypto firms. When Coinbase first launched debit cards in Europe in 2019, Worldpay supported them.

Speaking at BVNK’s Currency LDN conference in May 2024, Caitlin Kulowoski, Director – Crypto at Worldpay, explained: “We’re facilitating global expansion for our crypto merchants on the card processing side… settling them in stablecoins was a natural progression.”

In 2022, Worldpay began offering merchants a portion of their settlements in USDC stablecoins. In2024, the acquirer completed its stablecoin pilot with Visa to get merchants their funds even faster, by cutting out another step of the process. Caitlin explained: “Visa sends USDC to Worldpay's wallet and we pass it on to the merchant, without having a minting process in between.”

Both projects have proven themselves, added Caitlin: “We're seeing great returns in terms of merchants who want this because they don't have bank account access, they want their funds faster, or they want cheaper cross-border fees.”

Worldpay is now looking at other enhancements, including settling merchants in stablecoins 7 days a week and settling businesses outside the crypto native space.

It’s also exploring a new use case: consumer payouts. Worldpay has seen interest in stablecoin payouts from businesses who may have been “timid initially to get involved in crypto,” said Caitlin: “Consumer payouts opens the door for stablecoins to be used by non crypto-native merchants like Etsy and Airbnb. These merchants may have sellers and hosts globally, in places where there is currency volatility or where they just can’t get access to banking.”19

Industry perspective: First Digital

Stablecoins will grow as Web3 grows, says First Digital founder

Vincent Chok, Founder & CEO of First Digital, Hong-Kong based issuer of stablecoin FDUSD, and provider of digital asset custody and tokenization services, gives his take on stablecoin use cases in Asia and the market opportunity.

In its first year, US dollar backed stablecoin FDUSD reached $4bn in market cap and became one of the top 5 traded assets on-chain. Despite being a newcomer, it also became one side of the highest trading pair with BTC, several times, hitting a peak volume of $23bn in 24 hours. So to what does First Digital founder Vincent Chok attribute the FDUSD’s early gains?

“It was partly a matter of timing, we were in the right place at the right time with what’s happening – along with the growing trend in the Asia stablecoin market,” he explains, “just months later, Hong Kong announced its stablecoin licensing regime.” At the time Binance was also sunsetting BUSD, adds Chok: “with our experience in managing reserves, we were able to come in and act as a replacement for BUSD customers.”

Finance for the unbanked

Today, stablecoins are no longer just a way to get into crypto trading, as many of them started. But use cases still differ a lot regionally, says Chok: “In the US, many people use stablecoins to purchase crypto on exchange. The picture looks different in Asia where lots of people are still unbanked.”

In countries like the Philippines and Indonesia, 1 in 2 adults don’t have a bank account according to the World Bank’s 2021 Index. Here stablecoins perform a more critical financial function, explains Chok: “It’s a sad reality, but because of the cost and complexity of adhering to global KYC and AML regulations, many banks don’t offer accounts for low-income earning people, so stablecoins are a way of building a financial footprint. With a stablecoin wallet, you can manage your wealth in your own way…. We think this is a huge market.”

The payroll opportunity in Asia

Building your financial footprint could start with getting a stablecoin paycheck, says Chok. “A lot of people work overseas now, and it’s often difficult to bank them. Let's say you're a foreign worker in Kenya. You’re paid in local fiat currency, but you don't have a Kenyan bank account. So you have to take half a day off to travel to the money changer, pay 100-150 basis points in conversion fees, and face the security risks of carrying a pocket full of cash on public transport.”

Stablecoins can solve a lot of these pains, says Chok: “Let’s say the employer pays us the salary for their workers in fiat. We convert to FDUSD and pay into each employee's payroll account on-chain. A worker might then want to convert FDUSD to a Central Bank Digital Currency (CBDC) in their home country and send it to their wallet. Or perhaps it's a tech consultant living abroad who gets paid in FDUSD, exchanges it for a different CBDC with us, and sends it home. First Digital is building its payroll product to serve these kinds of needs.”

The B2C market opportunity for stablecoins is significant, adds Chok, but to succeed, providers need to crack the KYC challenge. “You need the infrastructure to collect and manage KYC and AML information for retail clients,” says Chok. “It’s a lot of work to onboard thousands of customers a week – for us, it’s important to work with the right partners there.”

Instant cross-border settlement

While stablecoin payroll is in the works for First Digital, Chok says there are other payments use cases FDUSD already enables – like escrow. For high value purchases like property, trust is often an issue: “Who moves first?” says Chok, “With stablecoins, you hold stablecoins while the asset is being verified. Once there’s a sign-off, the stablecoins settle across the world in minutes, eliminating the need for a local escrow agent.”

The opportunity around cross-border stablecoin settlements is driving many providers to seek stablecoin licenses in multiple jurisdictions, says Chok. “Stablecoins are a global currency, they move freely around the world. But wherever wallets are held, you have to comply with local law, even if you’re not issuing there. This is a challenge, but one that we’re embracing at First Digital, and we’re pursuing licenses across APAC, Middle East and Europe.”

As Web3 grows, so too will stablecoins

Chok predicts that the market cap of stablecoins will grow to more than a trillion US dollars in the next 2-3 years. While we’ll see more adoption outside of crypto-native industries, a key driver of growth will be Web3, says Chok.

“Think of an artist who has created a piece of music as an NFT,” says Chok. “Any time someone downloads it, the royalty can be paid with a stablecoin directly to a wallet listed on the smart contract. There are many more applications. I don’t believe you wouldn't have Web3 without stablecoins. It’s a natural fit for these industries to grow together.”

Get all the insights

1 CoinMarketCap, July 2024

2 Coinmetrics Total Value Settled On-Chain 2023

3 Visa Onchain Analytics Dashboard, ©2024 Visa. All rights reserved. Subject to Visa terms of use: Visa Legal | Visa

4 Statista, Value of payments processed, PayPal, 2012 to 2023

5 Mastercard Full Year Financial Results 2023

6 Visa Onchain Analytics Dashboard, ©2024 Visa. All rights reserved. Subject to Visa terms of use: Visa Legal | Visa

7 Global Exchange Rate Adjustments, Bank of International Settlements, 2022

8 The international role of the euro, European Central Bank, 2022

9 B2B cross-border market sizing, Juniper Research

10 Ripple, 2018, Global Payments 2016 (McKinsey) & Company 2016

11 World Bank, 2022

12 DefiLlama

13 World Bank, June 2024

14 BVNK average fiat settlement times

15 B2B cross-border market sizing, Juniper Research

16 CB Insights: Future of Fintech, 2018

17 Ripple Insights, 2018

18 Global Payments 2016, McKinsey & Company

19 Currency LDN 2024, BVNK: Upgrading payments infrastructure with stablecoins and CBCDs

Latest news

View allGet payment insights straight to your inbox

.avif)

.avif)

.avif)