Blockchain in cross-border payments: a complete 2025 guide

How blockchain technology is reshaping global business payments – and what it means for your company.

Imagine sending $100,000 to a supplier in Singapore on Friday evening and having it arrive in their account within minutes. This isn't a pipe dream anymore. It's happening right now, and it's transforming how businesses move money across borders.

In just five years, stablecoin supply has grown from $5 billion to $305 billion (as of September 2025). While total stablecoin transaction volumes exceeded $32 trillion in 2024, payment-specific volumes are estimated at approximately $5.7 trillion (according to data from Visa).

And the best part is that businesses don't need to become crypto experts or hold volatile digital assets to benefit. Instead, modern payment partners handle the complexity while you get settlement in minutes instead of days, at a fraction of traditional costs.

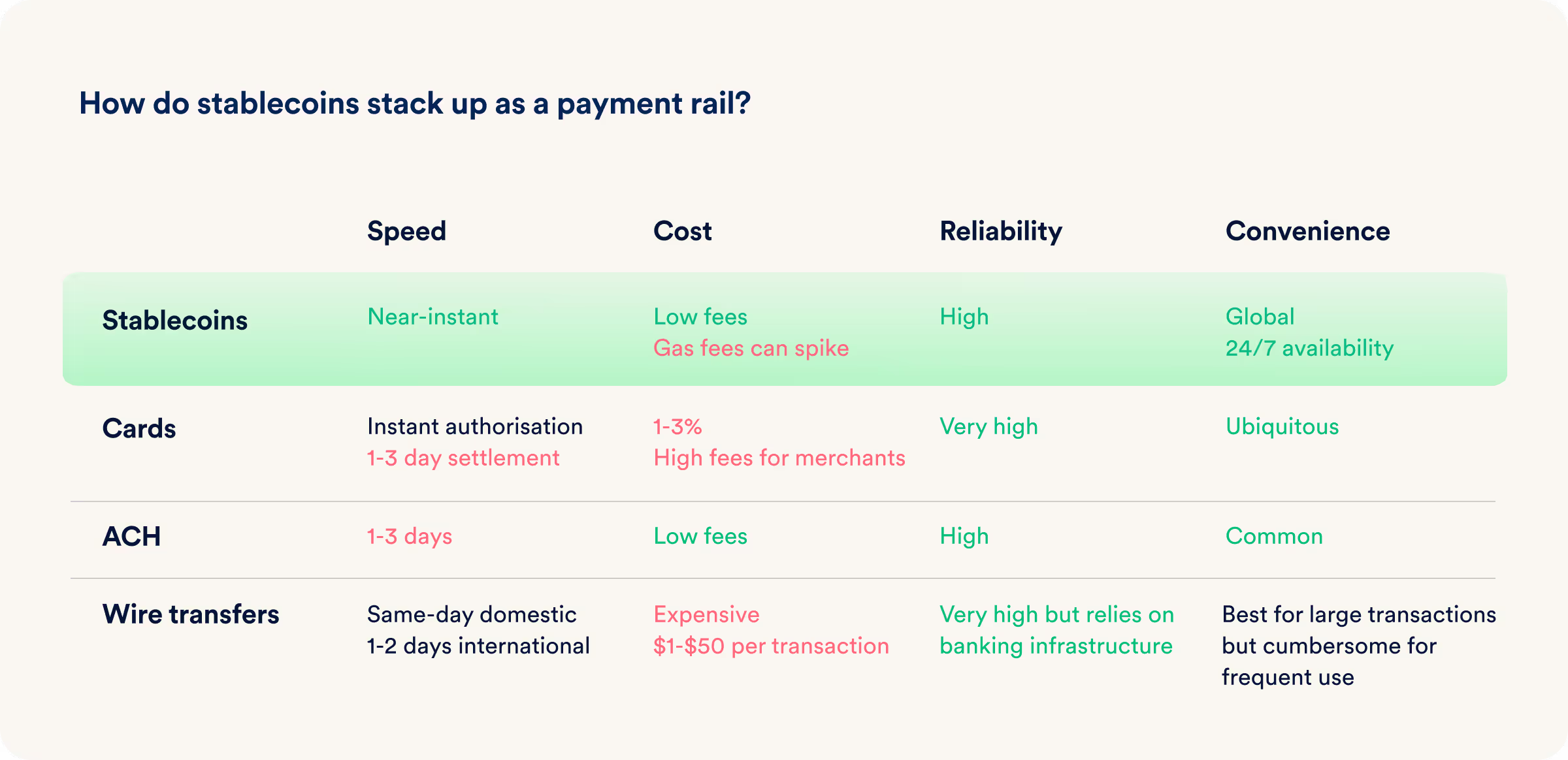

How blockchain payments outperform traditional cross-border transfers

Speed matters: Traditional cross-border wire transfers crawl along at 3-5 business days for some markets. But blockchain payments settle in under 3 minutes, any time of day, any day of the year.

Cost matters more: Traditional cross-border payments through banks can cost 2-7% when accounting for transfer fees, FX spreads, and intermediary charges. Blockchain payments can reduce these costs significantly, though total costs depend on multiple factors including network fees, processing fees, conversion spreads, and transaction volumes. For many businesses, the savings are substantial - particularly at scale.

Control matters most: No more waiting for correspondent banks or track down the status of your funds. Settlement is final, chargebacks are impossible, and you can track every transaction in real-time.

2025 is a turning point for cross-border blockchain adoption

The cross-border payments market is racing toward $290 trillion by 2030, according to data from FXC Intelligence, as cited in PitchBook’s Cross-Border Payments Deep Dive report.

At BVNK, we believe we're moving toward a world where a large majority of global money will exist in the form of stablecoins. In the next 10 years, stablecoins could reach 20% of the global cross-border payments market (from just a few per cent today).

Meanwhile, traditional banking infrastructure wasn't built for our borderless economy, and the cracks are showing.

That's why everyone from Tesla to Visa is embracing blockchain payments. Here's what's actually happening: Stablecoins processed $32 trillion in transactions last year alone. That's real money moving through a system that didn't exist a decade ago.

While everyone was debating whether crypto was legitimate, businesses quietly figured out that it could solve their biggest payment headaches.

The numbers that matter

- Stablecoin supply: From $5 billion to $305 billion in five years

- Transaction volume: $32 trillion processed in 2024

- Payment focus: $5.7 trillion in actual cross-border payments

- Speed advantage: Minutes vs days for settlement

- Market trajectory: BVNK projects that stablecoins could reach 20% share of global cross-border payments by 2030.

Understanding blockchain payments: The technology behind the transformation

Let's cut through the technical jargon and give you what you actually need to understand how this technology works.

What is blockchain technology?

Think of blockchain as a shared global digital ledger that no single company controls.

Instead of storing transaction records in one bank's database, blockchain creates identical copies across thousands of computers worldwide.

This means no single point of failure, no gatekeepers deciding who can transact, and no business hours or geographic limitations.

What are stablecoins?

A stablecoin is a cryptocurrency designed to maintain a stable value by being pegged to a reserve asset, such as a fiat currency like the US Dollar.

Often called "cash for the internet age," stablecoins combine the familiarity of traditional money with the speed and global reach of blockchain technology.

Unlike Bitcoin or Ethereum, whose prices fluctuate significantly, stablecoins solve crypto's biggest business problem: volatility. Popular examples include USDC and USDT.

Major asset-backed stablecoins have proven their reliability, with total supply reaching $305 billion in 2025, making them attractive for finance and payment teams.

Stablecoins allow users to send and receive payments globally in seconds rather than days, as transactions occur directly on digital ledgers (blockchains) instead of moving through traditional banking systems.

This provides consumers with global purchasing power regardless of local currency limitations, while businesses benefit from faster cross-border transactions and access to new markets.

Blockchain and stablecoins represent the most significant infrastructure upgrade to payments we've seen. Why? Because they're programmable, global, and instant – making them a better choice for many types of business transactions.

The key differences: Traditional payments rely on multiple intermediary banks, while blockchain payments cut out the middlemen entirely. Global reach is another key difference - stablecoins are the only truly global currency in operation today.

How stablecoin payments actually work

Here's why stablecoin payments work better than traditional systems:

No single point of control: Unlike traditional payments that run through centrally controlled card and banking networks, blockchain operates without any single organization in charge.

The owners of traditional networks decide who gets access and how much to charge. Blockchain networks are open by default – you just need an internet connection.

Always-on operations: Blockchain networks operate 24/7/365. That means payments can be sent over weekends, during bank holidays, and outside normal banking hours. No more waiting until Monday for urgent Friday payments.

Built for reliability: Thousands of network participants maintain complete copies of the blockchain ledger. Even if dozens go offline simultaneously, operations continue without interruption.

Trust through consensus: Instead of trusting a single authority, blockchain relies on collective verification. Miners and nodes work together to maintain system integrity and security.

Complete transparency: Public addresses provide a transparent record of all transactions. This helps businesses analyze transaction patterns and track fund flows from origin to destination.

Cryptographic security: Transactions use advanced encryption, allowing two parties to complete payments without sharing sensitive information or requiring intermediaries like banks.

How to store, send, and receive stablecoins

Before processing payments, it's important to understand how stablecoins are actually held and transferred.

Stablecoins are stored in blockchain wallets, which come in two main types. Exchange wallets like those from Coinbase or Binance are easy to set up - simply create an account, verify your identity, and you can buy, store, and send stablecoins.

These are user-friendly but the exchange controls your assets. Self-custody wallets like MetaMask or Trust Wallet give you complete control through your own private keys, though you're fully responsible for security.

To send stablecoins to someone, you only need their wallet address and internet access.

Different stablecoins operate on specific blockchains (like Ethereum or Solana), so you'll need a compatible wallet. Each transfer includes a small network fee that varies depending on how busy the network is.

For businesses, payment providers like BVNK simplify the entire process by abstracting away technical complexity.

They offer access to all major stablecoins across different blockchains through a single API and interface - eliminating the need to manage multiple wallets or navigate different blockchain ecosystems.

This streamlined approach makes it easy for businesses to accept and process stablecoin payments without dealing with the technical challenges of blockchain technology.

Real business payment examples

BVNK supports businesses across four core use cases for stablecoin payments. Each offers distinct advantages depending on your business needs.

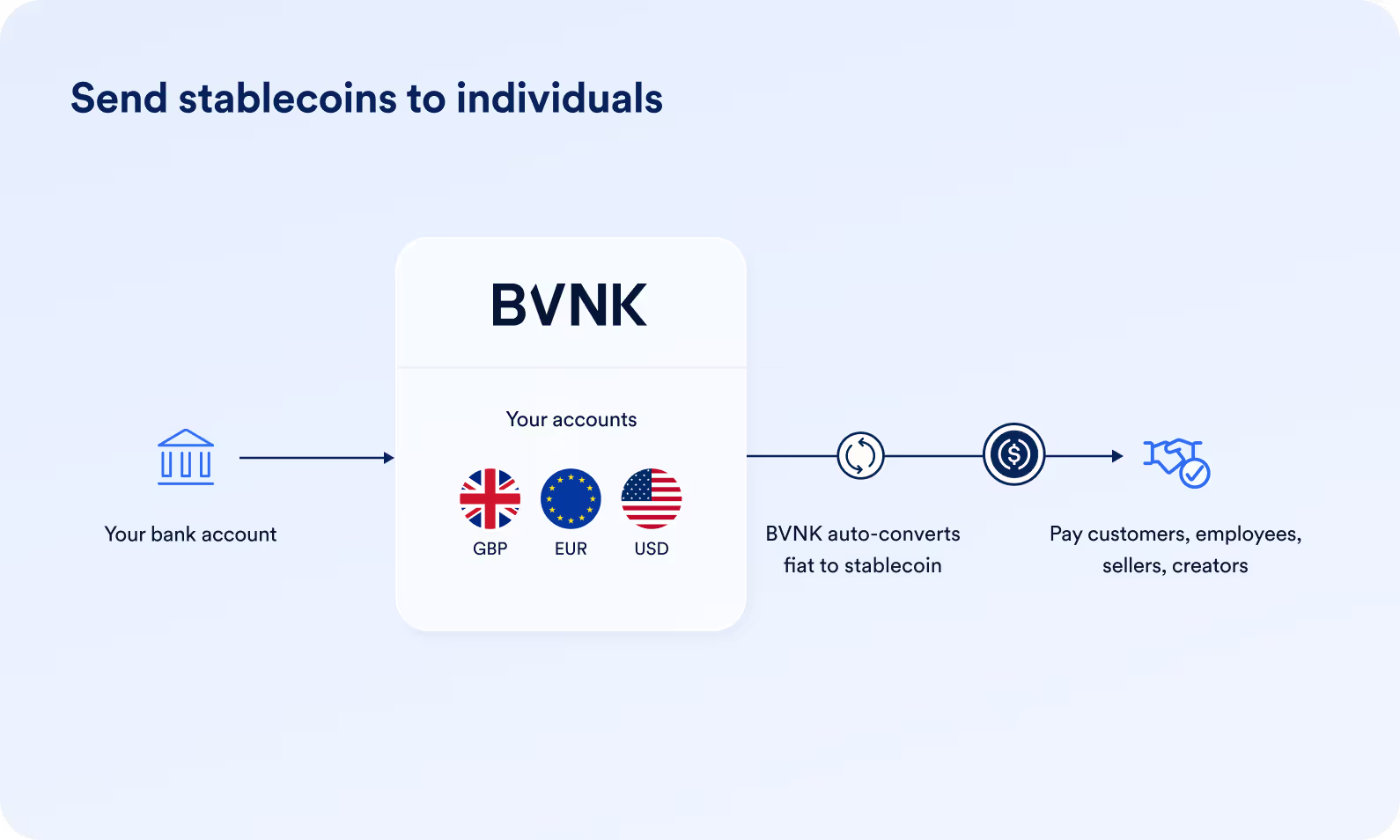

1. Send stablecoins to businesses and individuals

Pay suppliers, partners, workers and customers globally in stablecoins from a fiat balance. Alternatively, use a combination of stablecoins and fiat payment rails to accelerate cross-border payments to businesses and individuals.

Common use cases: Payment service providers, marketplaces, trading platforms, gaming, employer of record, payroll, and tech platforms

Why businesses use this: Settlement delays using traditional correspondent banking, demand from recipients to receive payment in stablecoins, problems getting local banking access, or unpredictable and high FX fees via traditional correspondent banking

How it works:

- Fund your account: Store funds in USD, EUR or GBP in named accounts accessible via major payment schemes (Swift, ACH, Fedwire, SEPA, Faster Payments)

- Request payout: Initiate stablecoin payout via API or the BVNK portal

- Automatic conversion: BVNK automatically converts from fiat to stablecoins on your behalf (no need to hold crypto)

- Track and report: Access full transaction reporting via the BVNK platform

Example scenario: Your contractor in Latin America withdraws their payment in stablecoins. You fund your BVNK account in USD, request the payout, and BVNK handles the conversion and delivery - settling in minutes rather than days.

2. Receive stablecoins from customers or partners

Accept stablecoin payments from customers or partners at checkout and automatically convert to your preferred fiat currency.

Common use cases: Luxury ecommerce, travel, marketplaces, payment service providers

Why businesses use this: Customer demand to pay in stablecoins, customer problems with traditional payment options in emerging markets (cards not valid for international transactions or blocked by providers)

How it works:

- Integrate: Add BVNK's pre-built payment pages or build your own checkout via API

- Customer pays: Customer selects stablecoin payment option, chooses their preferred currency and blockchain network, and completes the payment from their crypto wallet

- Automatic conversion: BVNK auto-converts from stablecoins to your preferred fiat currency (USD, EUR, or GBP) and updates your balance on the platform

- Access funds: Withdraw to your bank account or use to fund third-party payments via Swift, ACH, Fedwire, Faster Payments, or SEPA

Example scenario: A customer in Asia deposits funds to your trading platform using USDC. They complete the transaction in seconds, BVNK converts to USD, and you receive settled funds in your account - no manual processing, no multi-day delays.

3. Send cross-border payments via stablecoin rails

Mix stablecoin and local fiat payment rails to accelerate cross-border payments to businesses and individuals. Move seamlessly between currencies using stablecoins as the bridge. Sometimes called "the stablecoin sandwich."

Common use cases: Remittance companies, fintechs, PSPs, trading platforms, gaming

Why businesses use this: Reducing settlement delays versus using only fiat payment rails, avoiding high FX fees when converting using traditional banking networks, avoiding costly prefunding of accounts around the world

How it works:

- Deposit: Add USD to your BVNK account via Layer1 (BVNK's infrastructure product)

- Request: Send payout instruction via Layer1 for recipient to receive Mexican pesos

- Multi-currency conversion: Layer1 converts USD to stablecoins, sends instantly across borders, then converts to the destination currency (e.g., Mexican pesos) via off-ramp partners

- Delivery: Recipient receives local currency directly in their bank account

Example scenario: You need to pay a supplier in Mexico. Instead of waiting 2-5 days for traditional correspondent banking, you use stablecoin rails to bridge the gap.

BVNK handles the USD→USDC→MXN conversion seamlessly, and funds arrive in local currency the same day.

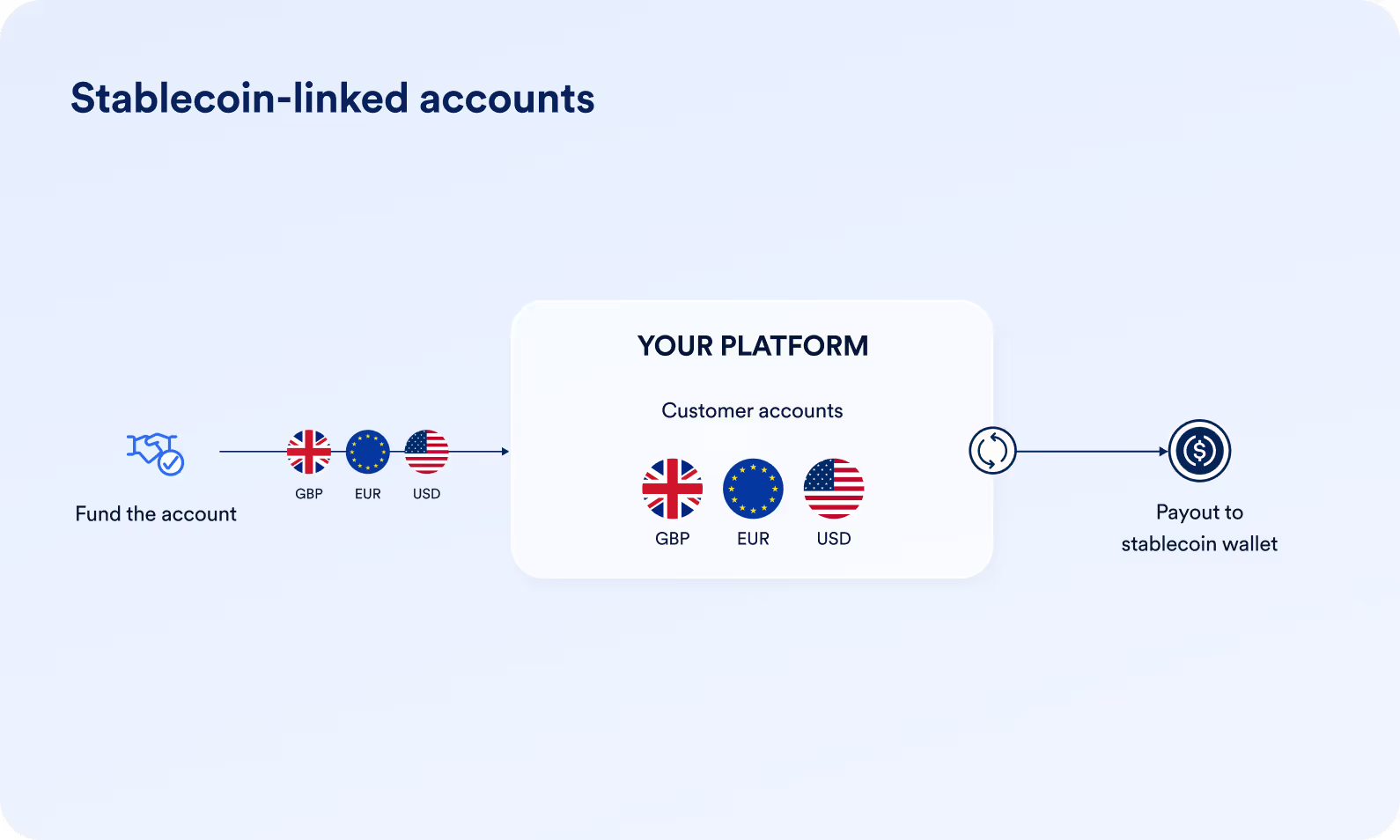

4. Store and manage funds with stablecoin wallets

With stablecoin wallets, you can let your customers hold funds in stablecoin wallets or stablecoin-linked accounts with access to ACH, Fedwire, SEPA, Swift and all the major blockchains. They can convert between fiat and stablecoins on demand, or keep value stored as stablecoins.

Common use cases: PSPs, fintechs, payroll, employer of record

Why businesses use this: Customer demand for stablecoin payments, competitive pressure to innovate and differentiate

How it works:

- Integrate: Connect with BVNK's API so your customers can manage both fiat and stablecoins in your ecosystem

- Onboarding: Your customer accepts BVNK's terms in your platform, you pass KYB/C data to BVNK via API, and BVNK initiates verification

- Account creation: Once verified, your customer creates stablecoin-linked accounts in your platform or

- Store and convert: Customers can fund accounts via ACH, wire, or by depositing stablecoins directly. They can store value as stablecoins or convert to fiat on demand. When making payouts, BVNK automatically converts between currencies as needed.

Example scenario: Your business customers want flexibility in how they hold and move money. They can deposit USD, hold it as USDC to protect against local currency fluctuations, then convert back to USD or pay suppliers directly in stablecoins - all from a single wallet within your platform.

Industry adoption: Who's already using blockchain payments?

This adoption story might surprise you. In 2025, global enterprises, traditional banks and financial institutions are just as likely as fintechs to develop blockchain payment solutions.

And the major players are moving fast. For example, Visa launched its Tokenized Asset Platform and is also using stablecoins to speed up cross border payments in partnership with BVNK.

Global payment providers like Worldpay, Lian Lian Global, dLocal, Flywire and Rapyd all partnered with BVNK to enable stablecoin payments for their customers.

Global payroll platform Deel launched stablecoin payouts for its contractors powered by BVNK, and Bank of America announced plans for its own stablecoin.

This isn't fringe technology anymore – stablecoins are transitioning from an alternative payment method to core financial infrastructure, and BVNK is powering this shift.

Four types of blockchain payment providers

When evaluating potential partners, you'll typically encounter four main provider categories:

1. Native blockchain companies: These own their blockchain and offer a native token (like Ripple with XRP).

2. Blockchain-focused, token-agnostic: These companies own blockchain infrastructure but work with multiple tokens (like Stellar).

3. Token-focused, blockchain-agnostic: These focus on specific tokens but work across multiple blockchains (like Circle with USDC).

4. Multi-blockchain, multi-token providers: These enable access to multiple blockchains and tokens and fiat currencies (like BVNK).

BVNK represents the last category – we unify traditional bank and blockchain payment systems.

This lets enterprises like Deel, Rapyd, and Worldpay accelerate global money movement through multiple approaches: paying suppliers in stablecoins from fiat balances, accepting stablecoins while auto-converting to USD/EUR/GBP, and using our Layer1 infrastructure to combine the best aspects of both systems.

Seven proven benefits of stablecoin payments for your business

1. Reaching new customers and markets

Offering stablecoin payments helps you reach demographics where traditional banking access is limited. Currently, 6.8% of the global population is estimated to own crypto (June 2025).

Importantly, 93% of crypto owners would consider making purchases with their digital assets. Major brands from Starbucks and Tesla to Whole Foods and Ferrari have added crypto payments and found that up to 40% of crypto-paying customers are entirely new to their business. These customers also tend to make purchases twice as valuable as typical credit card transactions.

2. Faster settlement eliminates cash flow gaps

Traditional international transfers through systems like Swift can take several days, especially when moving money in and out of emerging markets. Finance teams often resort to pre-funding accounts or accept cash flow pressures.

Blockchain settlement happens near-instantaneously and operates around the clock. This eliminates the cash flow gap between sales costs and revenue collection.

The difference is dramatic: Swift transfers between many markets take 3-5 days, while blockchain settlements complete in under 3 minutes. Stablecoins essentially replace both the messaging layer (Swift) and the money movement layer (correspondent banking).

Payment partners like BVNK can complete international payments in minutes using stablecoins.

3. Predictable, final settlement

Once blockchain transactions complete, they become permanent parts of the blockchain ledger. This means no chargebacks exist in blockchain payments.

This protects businesses from significant revenue losses and eliminates the operational burden of processing chargebacks. It also removes the potential for chargeback fraud.

4. Enhanced security and reliability

Blockchain networks have proven themselves through years of securely processing large cryptocurrency amounts daily.

The substantial volumes of stablecoins transferred on major blockchains demonstrate reliable, trusted exchange mechanisms.

Using advanced encryption, blockchain payments allow two parties to transact without sharing sensitive information or requiring bank intermediaries.

5. Simplified adoption path

You don't need to become a cryptocurrency expert or manage complex blockchain infrastructure.

Specialized providers like BVNK support all major blockchains and stablecoins, delivering enterprise-grade payment solutions that abstract away technical complexity.

These services allow businesses to accept payments in leading digital assets while maintaining operations in familiar fiat currencies like USD, EUR, or GBP through automatic conversion.

This approach gives you all the benefits of blockchain payments - speed, lower costs, and global reach - without the operational complexity or compliance obligations associated with directly handling digital assets on your balance sheet.

6. Complete transparency and tracking

While blockchain transactions don't reveal personal information directly, they provide complete traceability through public addresses and permanent records.

Stablecoins and digital assets are often referred to as the most trackable form of value transfer in existence.

This offers excellent visibility into payment status and supports payment reconciliation, financial record-keeping, and analysis.

Combined with blockchain analytics tools, distributed ledgers provide powerful capabilities for tracking fund origins and detecting suspicious payment activity.

Payment providers like BVNK add additional layers of protection beyond the blockchain's native transparency.

These include robust risk management frameworks, enhanced security compliance certifications (such as ISO standards), Travel Rule compliance for cross-border transfers, and sophisticated AML monitoring systems.

These safeguards ensure businesses can leverage the transparency benefits of blockchain technology while maintaining enterprise-grade security and regulatory compliance.

7. Significant cost reductions

Traditional cross-border payments often require multiple intermediary banks in correspondent banking relationships. Blockchains require far fewer, enabling direct processing between payer and recipient.

The cost difference is substantial: credit card fees typically range from 2-3%, while blockchain payments cost 0.5-1%. Research indicates that stablecoin cross-border payments could save businesses $10 billion by 2030.

Even when converting between fiat currencies (on-ramping and off-ramping), businesses can achieve significant savings depending on their provider and target currencies.

Remember that actual costs for businesses depend on several factors. Blockchain network fees vary significantly – from around $1-5 for an Ethereum transaction to less than a penny on Solana.

Payment providers typically charge processing fees (0.3-2%), with volume-based pricing tiers for larger customers. Additional costs may include conversion spreads (0.5-2%) when exchanging between currencies and potential platform fees.

Working with established payment providers like BVNK can help optimize these costs through their economies of scale, direct partnerships with stablecoin issuers, and access to deeper liquidity pools.

For businesses planning substantial payment volumes, it's worth discussing custom pricing arrangements that align with your specific transaction patterns and needs.

Implementation challenges and practical solutions

Despite clear advantages, blockchain remains a relatively young technology. Setup can be complex, and businesses are still determining optimal implementation approaches.

However, some challenges resolve naturally as technology evolves, while others can be mitigated by working with experienced partners who handle complexity and risk.

Managing volatility and price stability

Finance teams concerned about digital asset volatility can find reassurance in stablecoins, which are designed to maintain steady value through their pegs to established currencies like the US dollar. This design significantly reduces price fluctuation risks compared to traditional cryptocurrencies.

Working with payment partners like BVNK offers an additional layer of protection through auto-conversion capabilities. This means businesses can accept stablecoin payments without holding digital assets on their balance sheet.

The payment partner receives the stablecoin, automatically converts it to your preferred fiat currency (such as USD, EUR, or GBP), and deposits the funds directly to your account. This approach eliminates volatility concerns while still capturing the benefits of digital asset payments: lower costs, faster settlement, and broader global reach.

While stablecoins may occasionally experience temporary deviations from their pegs, major asset-backed stablecoins have proven their reliability through consistent usage and a combined market capitalization exceeding $300 billion.

This robust track record demonstrates their effectiveness as a practical payment solution for businesses seeking the benefits of blockchain technology without the volatility risks of traditional cryptocurrencies.

Overcoming network effects

The global economy still primarily runs on fiat currency, with stablecoins yet to reach critical mass. While stablecoins offer protection from local currency inflation, everyday expenses still require local currency.

Consider partnering with payment providers that enable both fiat and crypto/stablecoin payments for maximum flexibility. This allows paying suppliers in stablecoins from fiat balances or receiving stablecoins from partners while auto-converting to USD.

Cards are also emerging as the key transition mechanism – a "Trojan horse" for stablecoin adoption. These cards allow businesses and consumers to hold value in stablecoins while spending seamlessly within existing payment networks.

When you tap or swipe these cards, merchants receive fiat currency through familiar rails, while the transaction settles behind the scenes using stablecoins from your digital wallet.

For businesses, this means holding treasury assets digitally while maintaining complete spending flexibility without changing consumer behavior.

Addressing technical knowledge requirements

Blockchain payments require users to understand digital wallets and cryptographic keys. The complexity of securing private keys and protecting digital wallets can barrier widespread adoption.

Working with expert payment partners like BVNK helps address these challenges by handling technical complexity.

Navigating regulatory compliance

Digital asset regulations evolve quickly and remain inconsistent globally. Several comprehensive regulatory frameworks have emerged, including MiCA in the EU and GENIUS in the US. While specifics differ, all focus on core principles: customer protection, market stability, and market integrity.

Regulators achieve these outcomes through licensing requirements for crypto service providers, consumer promotion rules, and AML compliance requirements for customer due diligence, transaction monitoring, and reporting.

Working with licensed crypto asset service providers enables businesses to leverage crypto and stablecoin payment capabilities without requiring their own licenses.

Meeting AML compliance standards

Anti-money laundering rules form the foundation of financial services regulation. Global AML and Combating the Financing of Terrorism (CFT) rules apply to both traditional and crypto payments.

Hundreds of jurisdictions have enacted crypto AML rules following Financial Action Task Force (FATF) guidance.

When working with stablecoin payment partners, understand their AML approach. While rules vary slightly between jurisdictions, core obligations remain consistent.

Licensed crypto service providers must maintain effective financial crime control frameworks, conduct enhanced customer due diligence, and monitor transactions while reporting suspicious activity.

Stablecoin payment providers must also follow Travel Rule requirements, securely sharing information about payment senders and intended recipients – as already happens with fiat payments. AML compliance can be equally effective for crypto as for fiat when working with appropriate partners and tools.

Achieving interoperability

As blockchains (like Tempo, Base, and Sui) and stablecoins (USDG, EURC, and others) continue to proliferate, businesses face growing complexity when trying to support multiple networks and tokens.

BVNK addresses this through a unified API layer that abstracts away this complexity. Our single integration supports multiple blockchains, various stablecoins, and traditional fiat currencies simultaneously.

This means you can accept USDT on Ethereum today and add USDC on Solana tomorrow without additional development work.

This approach lets businesses treat digital asset payments just like normal payments. Your teams don't need blockchain expertise, and your customers enjoy familiar payment flows.

Behind the scenes, our infrastructure handles blockchain interactions, cross-chain settlements, and fiat conversions, delivering blockchain benefits without requiring technical expertise.

As new networks emerge, they're added to our platform, ensuring your payment capabilities expand automatically.

Managing energy consumption concerns

Proof-of-work blockchain networks like Bitcoin consume substantial energy. Energy-intensive operations can concern businesses with climate impact obligations.

However, most payment-focused blockchains use more energy-efficient consensus mechanisms than Bitcoin mining.

Implementation guide: Adding blockchain to your payment strategy

The financial world is undergoing a shift as seismic as the transition from analog to digital communications. At the heart of this shift are stablecoins. Stablecoins are creating a new base layer for financial services — one that’s global, real-time and accessible 24/7/365.

Recent developments, such as Circle's IPO and the launch of stablecoins by major financial institutions like JPMorgan and Fiserv, underscore this momentum.

At BVNK, we believe we're moving toward a world where a large majority of global money will exist in the form of stablecoins. In the next 10 years, stablecoins could reach 20% of the global cross-border payments market (from c.3% today).

Many businesses today are integrating stablecoins into their products and payment flows by partnering with enterprise-grade stablecoin payment providers like BVNK.

Here's a practical approach for businesses looking to integrate stablecoins.

Step-by-step implementation checklist

- Assess current situation: Evaluate cross-border payment volumes and identify main pain points

- Identify opportunities: Determine suitable payment corridors where blockchain offers advantages

- Evaluate options: Compare building internal capabilities versus partnering approaches

- Review requirements: Understand regulatory obligations in target markets

- Select partners: Choose payment partners or infrastructure providers

- Start small: Implement pilot programs with select suppliers or customers

- Monitor and optimize: Track results and refine based on performance data

With hundreds of deployments under our belt, we’ve got the expertise you need. Kick start your journey with our implementation guide.

Working with regulated partners

The past decade's rise of specialized payment companies and fintechs demonstrates the value of offloading complexity to experts while mitigating risks through third parties. The same principles apply to stablecoin payments.

Regulated partners provide several key advantages:

- Regulatory compliance: Avoid needing crypto asset licenses by transferring regulatory compliance burdens to specialized providers.

- Risk management: Keep digital assets separate from your treasury operations.

- Operational efficiency: Reduce operational overhead while avoiding fixed costs of internal development.

- Better economics: Access competitive cryptocurrency exchange rates while locking in pricing to prevent margin erosion.

Flexible implementation approaches

Most stablecoin payment providers lock customers into a single implementation model, but businesses have varying needs and resources. Consider these deployment options:

Managed services: Ideal for businesses seeking fast implementation without handling digital assets directly.

This approach leverages the provider's licensing, custody, and liquidity infrastructure – enabling you to accept stablecoins at checkout while automatically settling in fiat, ensuring digital assets never appear on your balance sheet.

BVNK's managed service allows businesses to go live within weeks with minimal technical resources, either through a portal interface or API integration.

Self-managed infrastructure: For businesses wanting greater control and cost efficiency at scale. This approach involves managing your own wallet infrastructure while connecting to a provider's payment rails.

It offers more flexibility but requires additional technical resources and typically longer implementation timelines. BVNK's Layer1 infrastructure enables this self-managed approach while still providing access to their established rails and liquidity networks.

The most flexible providers, like BVNK, support both models – allowing businesses to start with a managed approach for quick market entry and transition to self-managed infrastructure as volumes grow.

This flexibility enables businesses to implement multi-rail payment strategies that optimize for speed, cost, and compliance across different markets and use cases.

Future outlook: what’s coming next

The stablecoin payments industry has demonstrated remarkable growth in cross-border transactions. By providing faster settlements, reduced costs, and enhanced security, blockchain technology transforms how businesses process payments and move money internationally.

With increasing adoption by financial institutions and customers, maturing regulations and standards, and innovations adding speed and scalability, blockchain's future in cross-border payments looks promising.

Research by leading global bank Citi projects stablecoins could reach a multi-trillion-dollar payments market by 2030, and with $32 trillion in 2024 transaction volume, stablecoins are scaling faster than any other global payment rail today.

Still have questions about implementing blockchain payments in your business? Speak to an expert to discuss your specific cross-border payment challenges and opportunities.

FAQs

How much do stablecoin cross-border payments cost?

Stablecoin payments typically cost 0.5-2% (versus 2-7% for traditional bank transfers). Actual costs vary based on network fees, processing fees, volume, and currency conversion. Learn more about cost factors.

Do businesses need to hold cryptocurrency to use blockchain payments?

No. Partners like BVNK enable businesses to send and receive blockchain payments while settling in traditional currencies, avoiding direct cryptocurrency exposure.

What's the actual settlement time for blockchain payments?

Blockchain payments settle in a few minutes globally depending on the network, and operate 24/7/365, compared to 3-5 business days for SWIFT transfers (excluding weekends and holidays).

Which blockchain networks are most commonly used for cross-border payments?

Ethereum, Tron, Binance Smart Chain (BSC) Solana and Base are the primary networks for stablecoin transfers, with USDC and USDT being the dominant payment tokens. Between them USDT and USDC make up 99% of stablecoin payments volume. Learn more

What's the difference between blockchain and cryptocurrency for payments?

Blockchain is the underlying technology creating a distributed ledger. Cryptocurrency is the digital currency that moves on blockchain networks. For payments, stablecoins (cryptocurrencies pegged to fiat currencies) are most commonly used.

What are the regulatory requirements for blockchain payments?

Requirements vary by jurisdiction but generally include licensing for service providers, AML compliance, customer due diligence, and transaction monitoring. Working with licensed partners handles these obligations for businesses.

How do stablecoins maintain their value?

Major stablecoins like USDC and USDT are backed by reserves of fiat currency or other stable assets. These reserves are held by regulated financial institutions and regularly audited to ensure the peg is maintained.

Latest news

View allGet payment insights straight to your inbox

.avif)

.avif)

.avif)

.avif)